Declining Network Activity Dampens ETH Burn

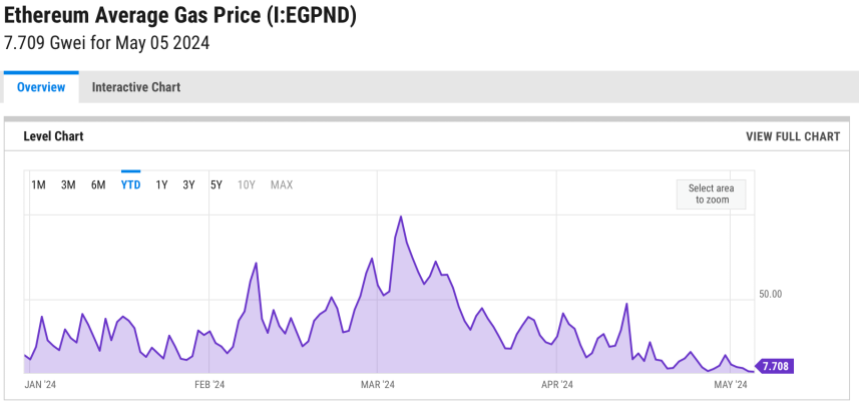

Ethereum’s burn rate has hit a yearly low in April due to a drop in network transaction fees. This means fewer ETH coins are being destroyed, which could impact Ethereum’s deflationary model.

Layer 2 Solutions and Innovations Lower Gas Fees

The migration of network activity to Layer 2 solutions and innovations like blob transactions have significantly reduced gas fees. While this benefits users, it also reduces the amount of ETH burned.

Shift to Inflationary Trend

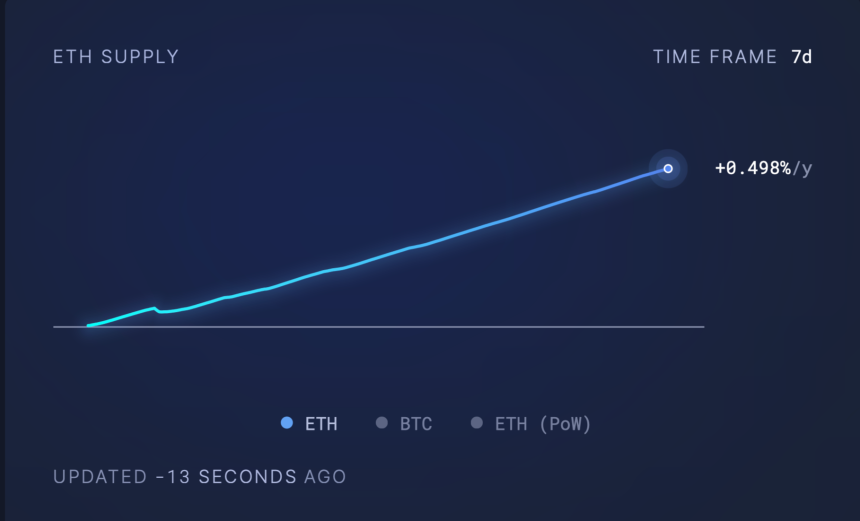

With lower transaction fees, the anticipated deflationary pressure from burning has eased. According to Ultrasoundmoney, Ethereum’s supply growth rate has turned mildly inflationary.

Market Response

Despite the underlying network dynamics, Ethereum’s price has not fully recovered. It remains below $3,500, reflecting the broader market’s reaction to regulatory concerns and economic uncertainties.

Looking Ahead

The trajectory of Ethereum’s gas fees and burn rate will be crucial in determining the sustainability of its economic model. Increased network activity could lead to higher burn rates and a return to deflationary pressure.