Options Market Sentiment

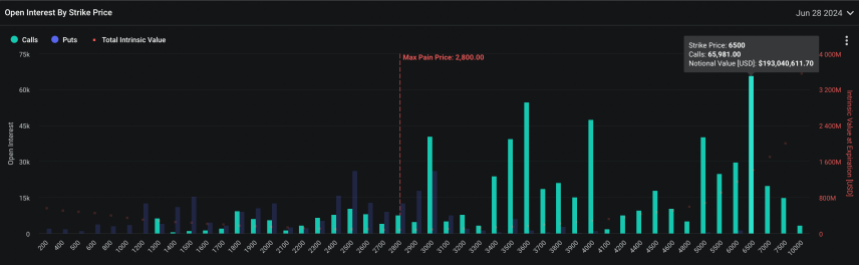

Traders are betting big on Ethereum (ETH) reaching new heights in June. Options data shows a surge in interest in higher strike prices, with a focus on levels above $3,600. This indicates a bullish outlook for Ethereum’s short-term trajectory.

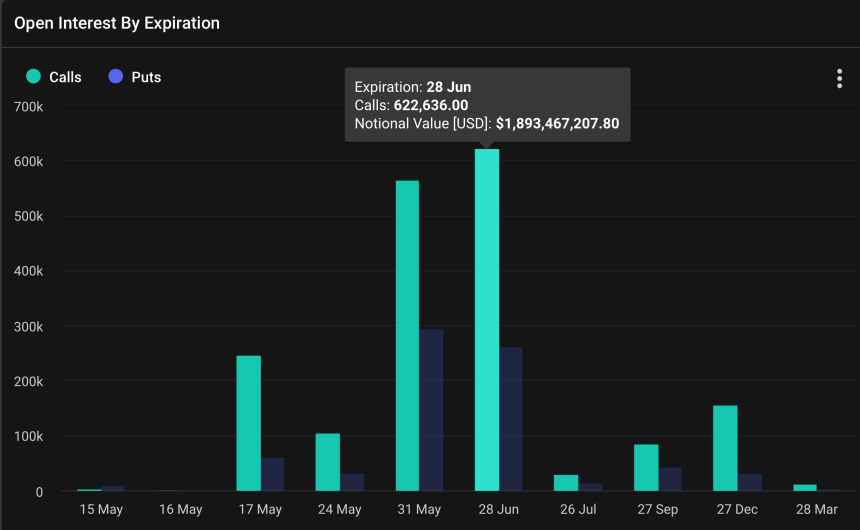

Call Options Dominate

Options contracts give traders the option to buy (calls) or sell (puts) an asset at a specific price. Calls are popular among traders who believe the asset will rise in value. Currently, the Ethereum options market is heavily tilted towards calls, suggesting that many traders expect the price to climb.

$6,500 Strike Price in Focus

The most popular strike price among bullish traders is $6,500. This reflects optimism about Ethereum’s potential and suggests that traders believe the price could reach or exceed this level by the end of June.

Technical Indicators Hint at a Rebound

Despite a recent dip, technical indicators suggest that Ethereum could be at a turning point. The “Bullish Cypher Pattern” indicates a possible rebound, and the current price is at a key support level that has historically acted as a launchpad for upward price movements.

Regulatory and Market Catalysts

Upcoming events could significantly impact Ethereum’s price. The SEC’s decision on Ethereum-based ETFs could bring in institutional investments, while technical indicators point to a potential bounce. These factors will shape Ethereum’s trajectory in the coming weeks.