Bitcoin Holdings Surge

MicroStrategy has purchased an additional 3,000 Bitcoin (BTC), bringing its total holdings to 193,000 BTC. This massive investment has now crossed the $10 billion mark, thanks to the recent surge in BTC’s price.

Unrealized Profits Skyrocket

MicroStrategy’s average purchase price for BTC is $31,544. With BTC currently trading above $57,000, the company is sitting on an unrealized profit of nearly $5 billion.

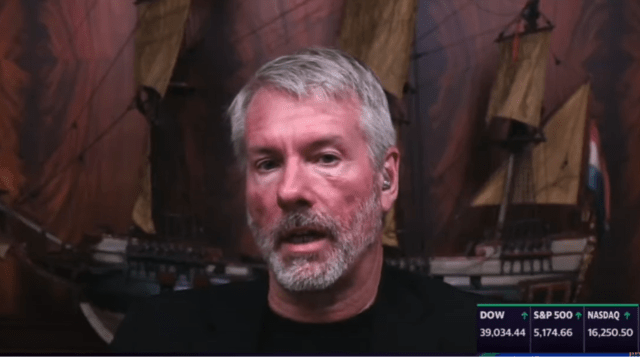

Saylor’s Bitcoin Strategy

MicroStrategy’s Bitcoin strategy, led by co-founder Michael Saylor, began in 2020 as a way to protect against inflation and diversify the company’s reserves. Despite market downturns, Saylor has remained bullish on Bitcoin, viewing it as an “exit strategy.”

Corporate Demand Drives Market

MicroStrategy is the largest corporate holder of BTC, but institutional demand is also increasing. Spot Bitcoin ETFs have contributed significantly to this demand, with trading volumes surpassing $2 billion.

BlackRock’s Role

BlackRock, the world’s largest asset manager, has been a major player in the Bitcoin ETF market. Its iShares Bitcoin ETF (IBIT) recorded a trading volume of $1.3 billion on February 27.

Bitcoin’s Price Rally

The strong demand for Bitcoin, including from institutional investors, has contributed to its recent price rally. At the time of writing, BTC is trading around $57,100.