Ethereum has been underperforming lately, leaving investors wondering if its days as a top cryptocurrency are numbered.

Weak Fundamentals

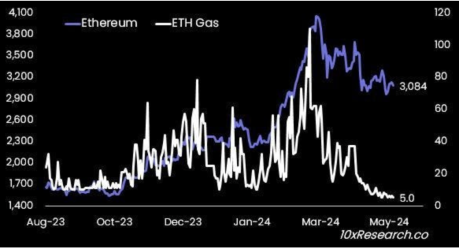

- Ethereum’s price has been stuck around $3,100, showing a lack of upward momentum.

- The cryptocurrency is closely tied to Bitcoin but has been underperforming despite Bitcoin’s record highs.

- Ethereum’s failure to deliver timely upgrades, such as reducing high gas fees, has dampened demand.

- Other Layer 1 networks, like Solana, have gained users at Ethereum’s expense.

Spillover Effect on Bitcoin

- Ethereum’s weak fundamentals are affecting Bitcoin by preventing new money from flowing into the crypto market.

Declining Stablecoin Usage

- Ethereum used to dominate stablecoin transactions but has lost market share to networks like Tron due to high fees.

Inflationary Issuance

- Ethereum’s issuance has become inflationary again, with more ETH being issued than burned.

- Staking rewards have also dropped, reducing bullish sentiment.

Bearish Outlook

- Given these developments, analysts believe it’s better to bet against Ethereum (short) rather than for it (long).

- Ethereum’s fragile fundamentals are not yet fully reflected in its price, which could lead to a potential crash.