Ethereum has once again broken above the $3,000 mark, after previous attempts failed due to FOMO (fear of missing out).

Brief Recovery

In the past day, Ethereum (ETH) has rallied 3%, breaking back above $3,000. This is the third attempt at this level, with the previous two resulting in brief surges followed by retracements.

Recent Surge

In the latest surge, ETH recovered sharply by over 3%, moving from around $2,900 to its current levels. This brings its weekly gain to 8%, making it the second-best performer among the top 10 cryptocurrencies, behind BNB’s 10% profits.

Market Sentiment and FOMO

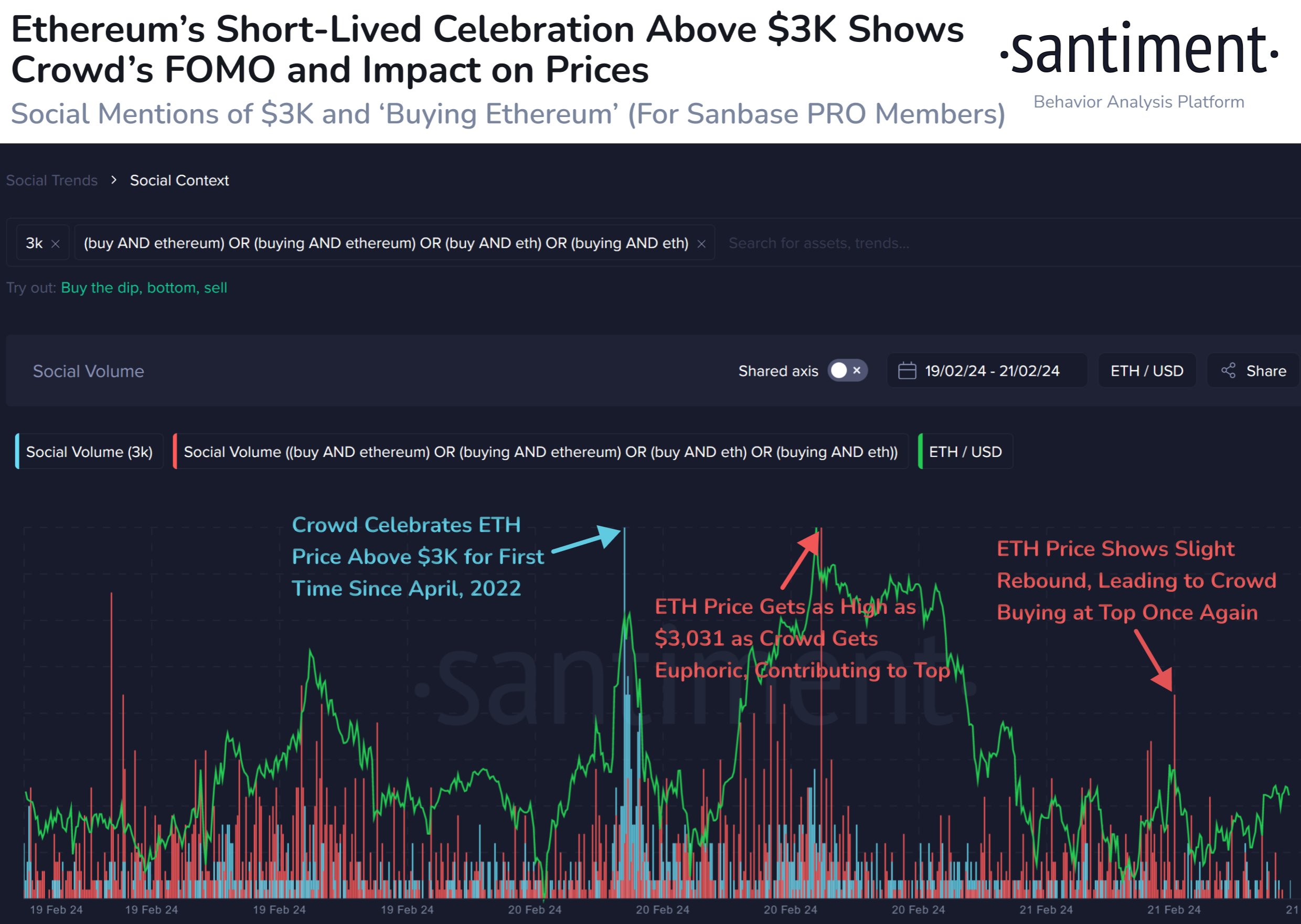

Data from Santiment suggests that market sentiment may have contributed to the failure of previous surges. The “Social Volume” indicator, which measures discussions on social media, spiked when ETH first broke above $3,000 a few days ago. This suggests that traders were excited about the breakout, but the surge was short-lived.

FOMO and Market Tops

Historically, FOMO has often led to market tops, as ETH’s price tends to move against crowd expectations. This may explain why the previous surge coincided with a spike in social volume.

Latest Rally

A similar pattern occurred during yesterday’s small recovery surge, as highlighted by Santiment. Greed appears to have caused the coin to top out once again.

Outlook

It remains to be seen how the market will react to the latest rally above $3,000. If FOMO spikes again on social media, it could be a sign that this surge may also be temporary.