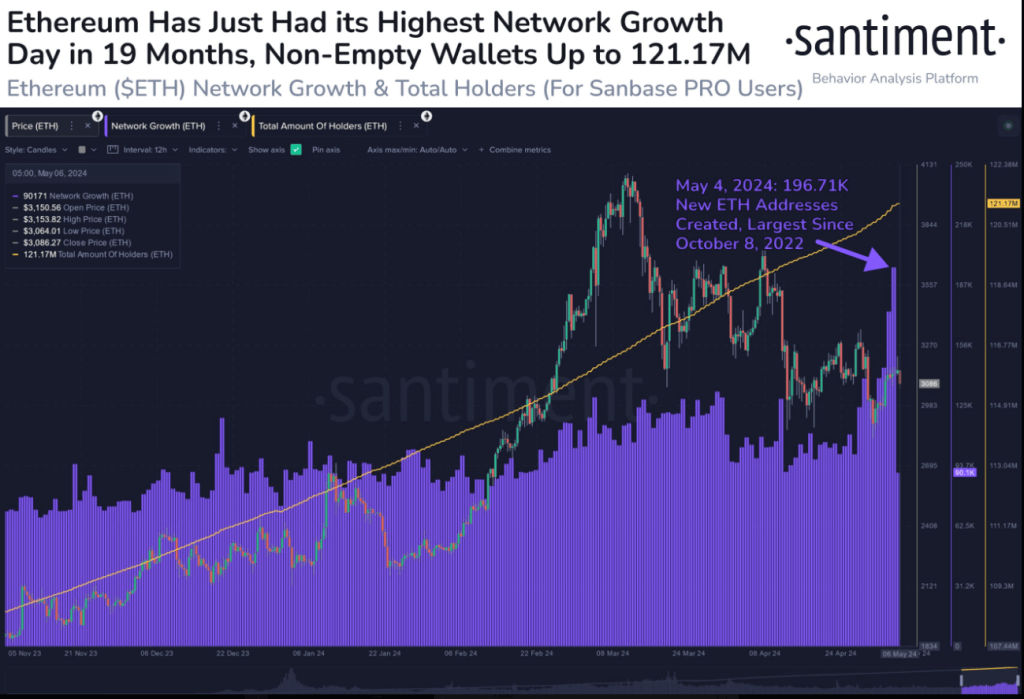

Network Surge

Ethereum’s network is seeing a surge in activity, with over 200,000 new addresses created on May 4th. This is the highest single-day growth in almost two years. The surge suggests growing interest in Ethereum, driven by DeFi and NFTs.

Price Dip: Opportunity or Risk?

Despite the network growth, Ethereum’s price has dipped to $2,995. However, the decline is accompanied by low trading volume, indicating that selling pressure may be weakening. Historically, this has often led to price reversals.

Potential Fed Pivot

The recent economic weakness in the US has raised speculation that the Federal Reserve may ease interest rates. This could benefit riskier assets like cryptocurrencies, including Ethereum. Lower interest rates make holding crypto more attractive than traditional investments.

Outlook

Ethereum’s future is uncertain. While the network is strong, the price faces challenges. Investors should consider both on-chain activity and the economic landscape when making decisions.

Key Factors to Watch

- Regulation: Clarity around cryptocurrency regulations will attract institutional investors.

- Innovation: Continued development in DeFi and NFTs will drive network growth.