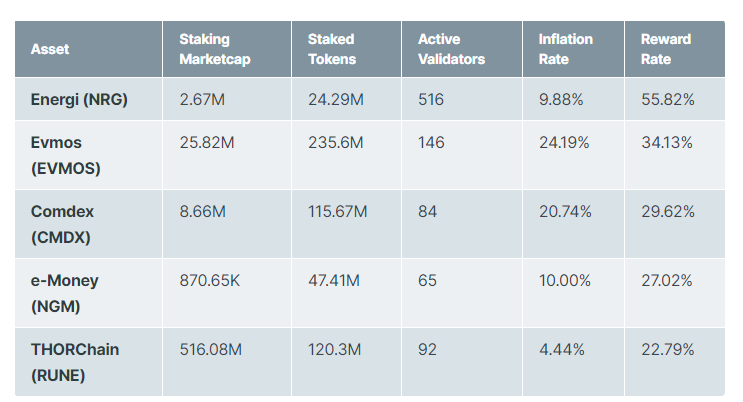

Investors are always on the lookout for promising opportunities in the crypto market, especially when it comes to alternative coins (altcoins). According to data from The TIE, a well-known digital asset information service provider, here are five altcoins that stand out with their impressive staking rewards.

High Yields in January: Exploring the Top Contenders

1. Energi (NRG):

Leading the pack is Energi, offering a remarkable reward rate of 55.82%. With a staking market capitalization of $2.67 million and 24.9 million tokens staked, Energi provides an enticing opportunity. The network is supported by 516 active validators, ensuring robust security and operational efficiency. Despite an inflation rate of 9.88%, Energi’s high reward rate remains a strong attraction for investors.

2. Evmos (EVMOS):

Following closely is Evmos, boasting a reward rate of 34.13%. With a staking market cap of $25.82 million and 235.6 million tokens staked, Evmos operates with 145 active validators, showcasing its network stability. However, investors should be aware of its relatively high inflation rate of 24.19%, which might impact long-term rewards.

3. Comdex (CMDX):

The third contender, Comdex, offers a reward rate of 29.62%. With a staking market cap of $8.66 million and 115.67 million tokens staked, Comdex maintains a reliable network supported by 84 active validators, balancing its 20.74% inflation rate.

4. e-Money (NGM):

In the fourth position, e-Money presents a reward rate of 27.02%. Despite a lower staking market cap of $870,650 and 47.41 million tokens staked, e-Money operates efficiently with 65 active validators. However, its inflation rate stands at 10.00%, making it a viable option for those seeking portfolio diversity.

5. THORChain (RUNE):

Rounding out the top five is THORChain, offering a reward rate of 22.79%. With a significant staking market cap of $516.08 million and 120.3 million tokens staked, THORChain stands out as an attractive option. Supported by 92 active validators and a modest inflation rate of 4.40%, it strikes a balance between reward potential and stability.

A Deeper Dive into Altcoin Staking

This analysis, based on the latest data from The TIE, provides insights into the potential of altcoin staking. While high staking rewards are appealing, it’s crucial to consider other factors such as network stability, validator activity, and inflation rates to make well-rounded investment decisions.

Past Lessons: Finding the Right Balance

In the past, many projects struggled to balance high staking rewards and inflation, as seen in the case of PancakeSwap (CAKE). The community raised concerns about token inflation, prompting the PancakeSwap team to revamp tokenomics by cutting the maximum supply by 40% in December 2023.

Final Thoughts and Disclaimer

As we explore the world of altcoin staking, it’s important to note that high staking rewards should be weighed against factors like network stability and inflation rates. This information, grounded in The TIE’s data, aims to provide accurate insights, but readers are encouraged to verify facts independently and seek professional advice before making any investment decisions.