Inflows Dry Up

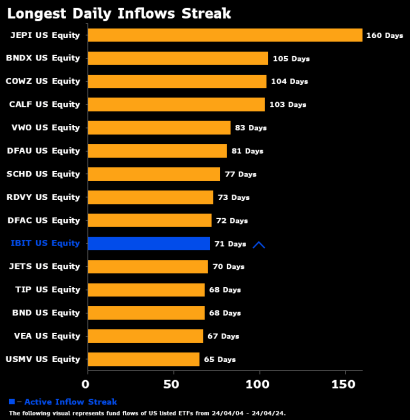

BlackRock’s Bitcoin ETF (IBIT) has hit a snag in its impressive run. After 71 consecutive days of inflows, the ETF recorded zero inflows on Wednesday. This is the first time in almost three months that IBIT has not seen any new money coming in.

Turning Point?

IBIT had been leading the pack among Bitcoin ETFs, boasting the highest inflows and trading volume. However, this recent pause in inflows could signal a shift in the fund’s trajectory.

Other ETFs Also Struggle

BlackRock wasn’t the only ETF to experience a lack of inflows on Wednesday. Eight other Bitcoin ETF issuers also reported zero inflows.

Fidelity and Ark Invest Buck the Trend

Fidelity and Ark Invest were the only managers to record inflows during Wednesday’s session, with $5.6 million and $4.2 million, respectively.

Grayscale’s Woes Continue

Grayscale, one of the largest BTC holders, continues to face outflows. On Wednesday alone, its ETF GBTC saw a staggering $130 million outflow.

Declining Demand and Negative Funding Rate

In other Bitcoin market news, bullish traders are scaling back their positions. The Bitcoin funding rate, which measures the premium paid to open new long positions, has turned negative for the first time since October 2023. This indicates a decrease in demand for Bitcoin.

Hong Kong’s New ETFs

The cryptocurrency market is now looking to Hong Kong, where a new set of spot Bitcoin ETFs is set to launch. It remains to be seen if these ETFs will generate the same level of demand as their US counterparts.