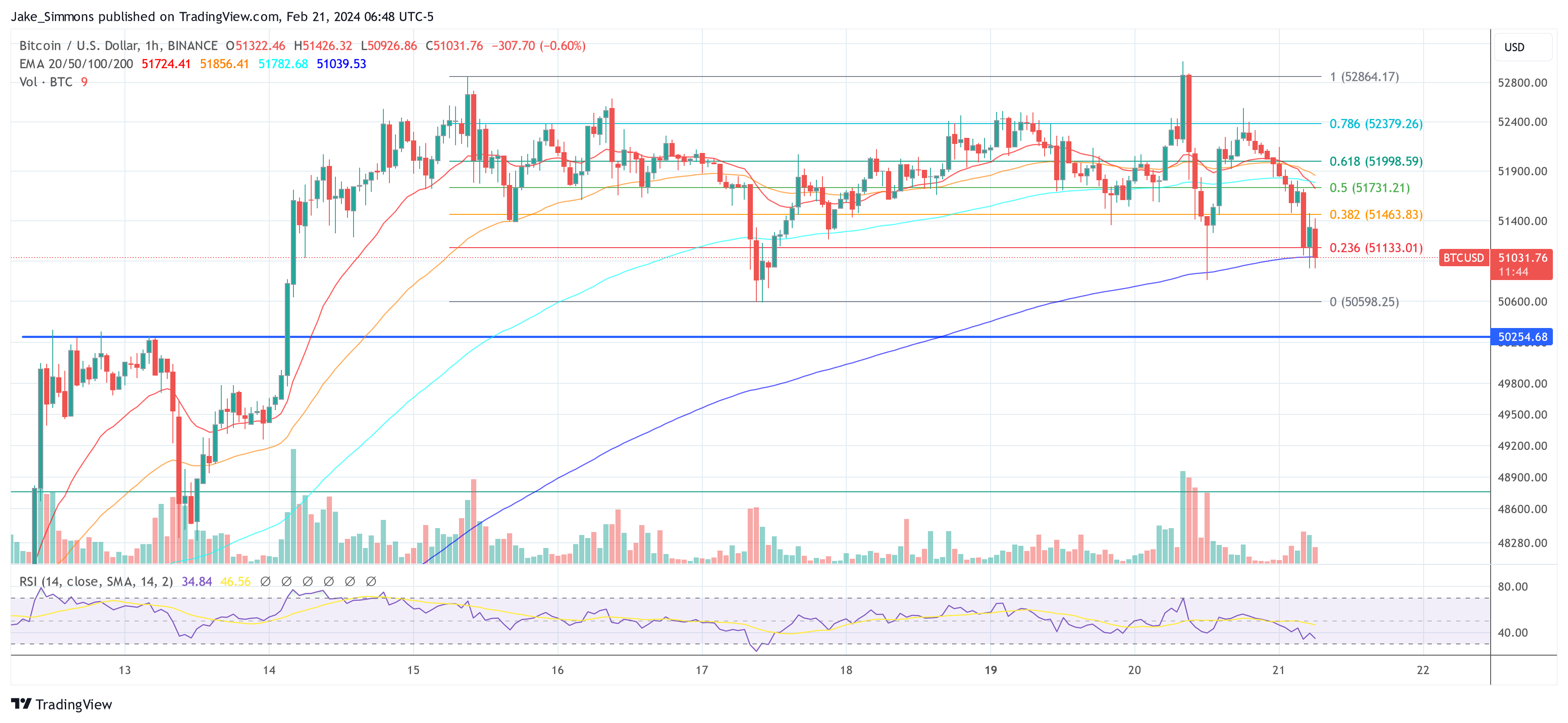

Yesterday, Bitcoin took a roller coaster ride, briefly touching $53,000 before crashing to $50,820. Amidst the chaos, one thing stood out: a huge surge in trading volume for certain Bitcoin ETFs.

ETF Trading Boom

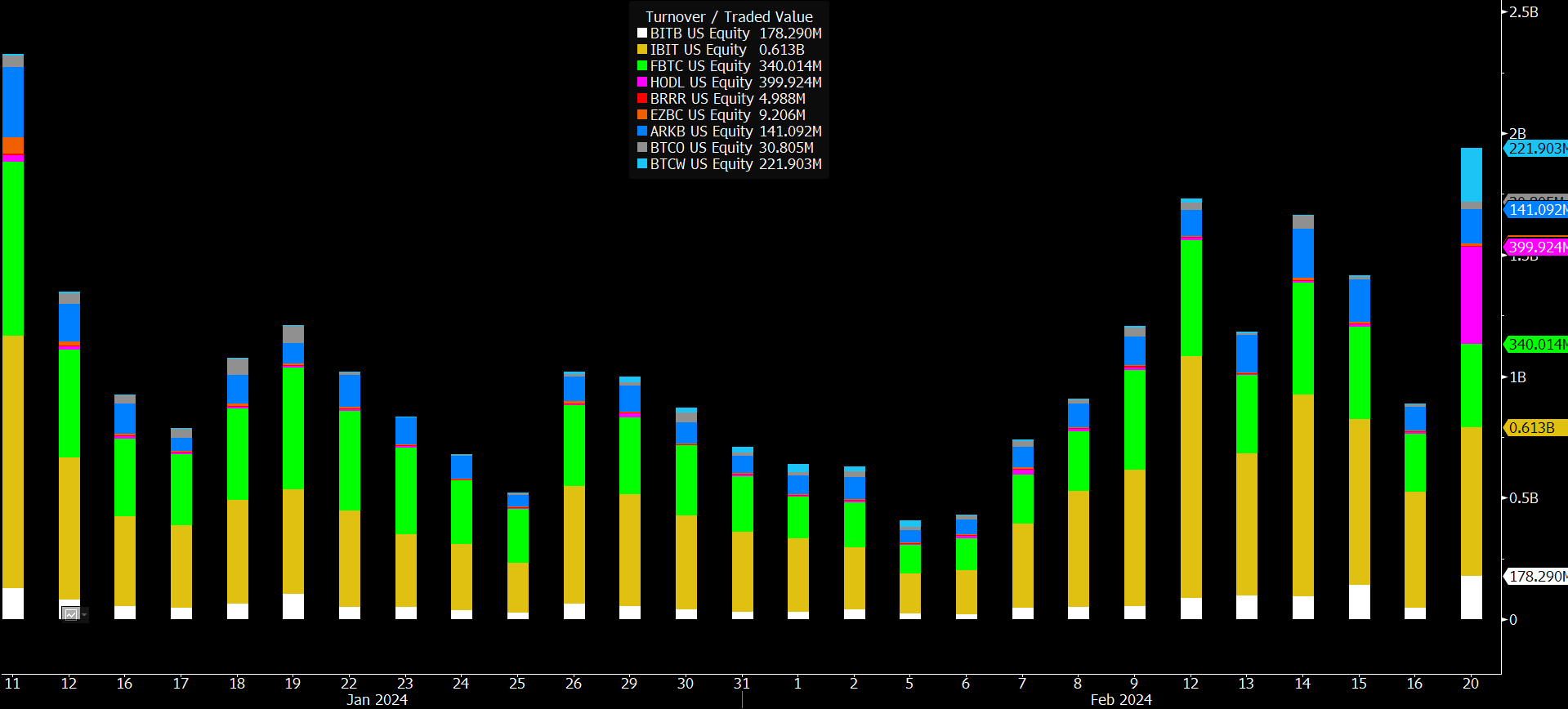

Bloomberg’s Eric Balchunas noticed something unusual. The VanEck Bitcoin ETF (HODL) saw a whopping 14x increase in trading volume, with over 32,000 individual trades. That’s 60x its average!

Other Bitcoin ETFs, like Wisdom Tree’s BTCW and BlackRock’s IBIT, also saw a boost in trading, but not as dramatic as HODL.

What’s Driving the Surge?

Balchunas dismissed the idea that the ETF volume surge was causing Bitcoin’s price drop. He pointed out that these ETFs are relatively small and don’t have many existing shareholders.

So, what’s behind the sudden spike? Balchunas thinks it could be a social media influencer or a “retail army” of small investors. He also considered market makers trading among themselves, but that seems unlikely.

Record-Breaking Day

The trading day ended with “The Nine” (a group of Bitcoin ETFs) hitting record-breaking volume. HODL, BTCW, and BITB all shattered their previous records.

Implications and Outlook

The Bitcoin community is still trying to understand what this volume surge means for Bitcoin ETFs and the market as a whole. The exact cause remains a mystery, but analysts are watching closely for further developments.