Bitcoin Supply in Profit Surges

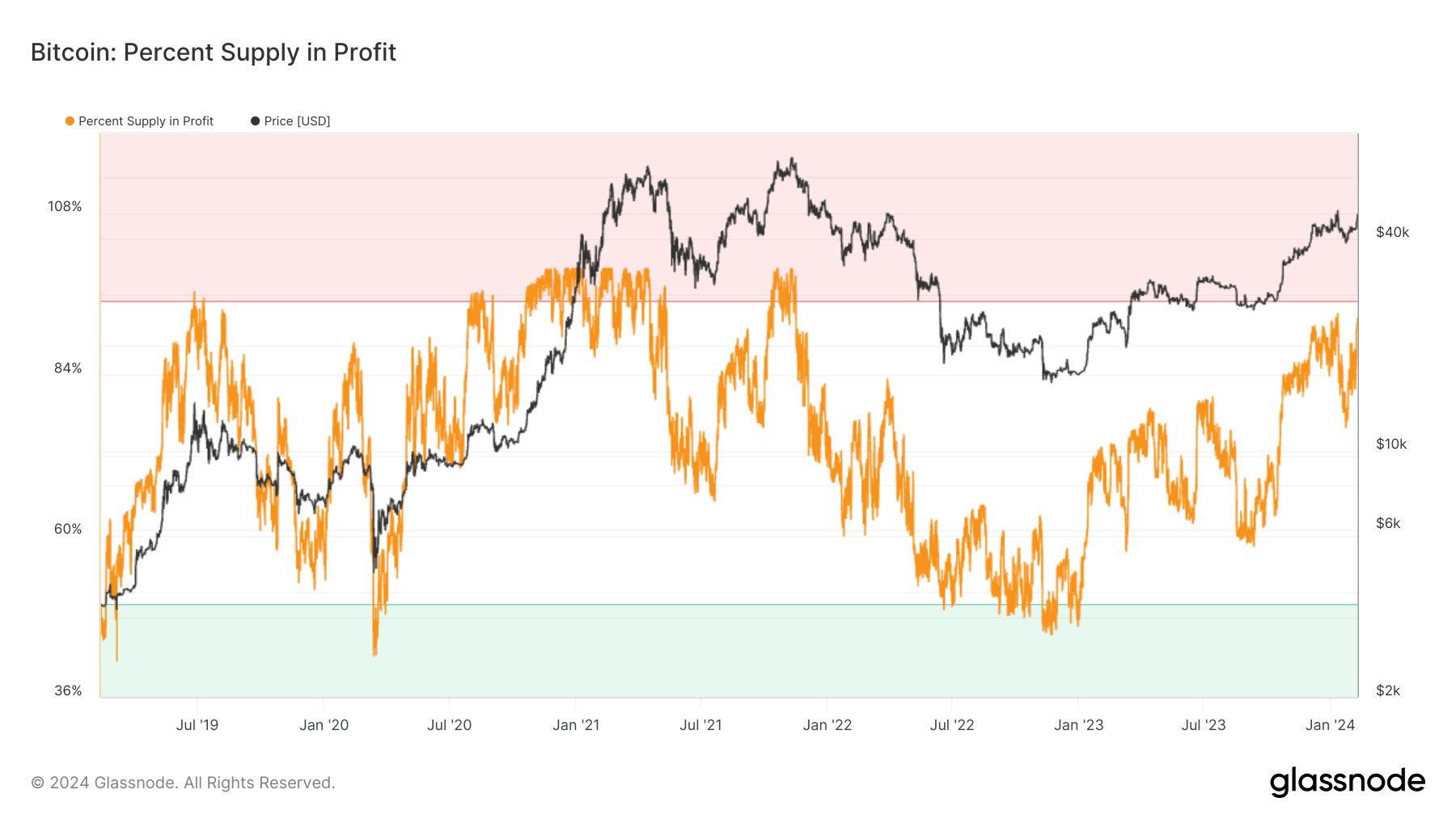

On-chain data shows that the Bitcoin Supply in Profit has neared the 95% mark during the recent rally. This indicator tracks the total percentage of the Bitcoin supply carrying some unrealized gain.

Historical Significance of Percent Supply in Profit

Analyst James Van Straten observes that historically, when the Bitcoin Percent Supply in Profit approaches 95%, it has often signaled a top for the asset. This is because profitable investors are more likely to sell their coins, leading to a potential mass selloff.

Current Levels and Implications

The recent surge in the Bitcoin Percent Supply in Profit suggests that the coin may be on the verge of hitting a local top, if not already. This is supported by the fact that BTC has cooled off since its earlier surge and has retreated towards the $47,900 level.

Opposite Region: Percent Supply in Loss

The opposite of the Percent Supply in Profit is the Percent Supply in Loss, which tracks coins that are currently holding a loss. When the Percent Supply in Loss is high (above 50%), it often indicates a bottom for Bitcoin. This is because there are fewer profit sellers left in the market, leading to a potential exhaustion of selling pressure.

Conclusion

The high levels of the Bitcoin Percent Supply in Profit suggest that the coin may be approaching a top. However, it is important to note that this is just one indicator, and other factors should also be considered when making investment decisions.