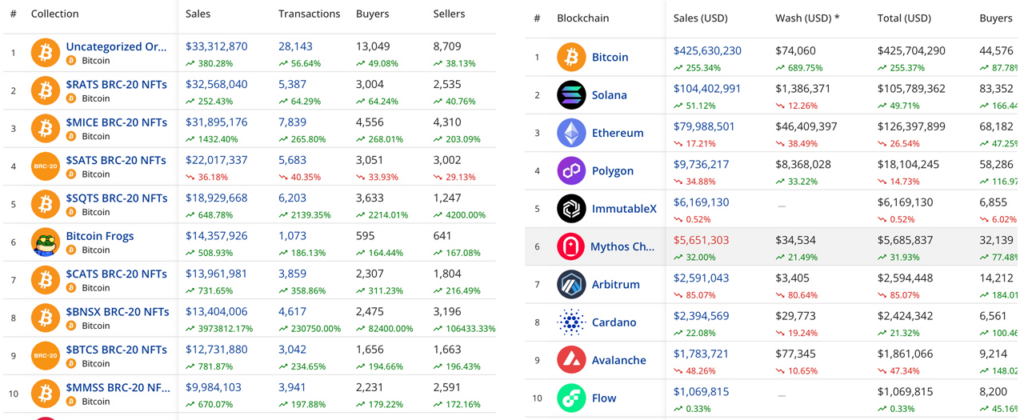

This week, the world of Bitcoin non-fungible tokens (NFTs) has been buzzing with activity, recording a staggering $425.63 million in sales. Notably, the top ten NFT collections, all hailing from the Bitcoin blockchain, have been at the forefront of this surge. Among them, collections known as Ordinal inscriptions have shown significant trading volumes, setting a robust foundation for the value of these digital assets.

The Rising Tide of Bitcoin-based NFTs

Over the last six weeks, NFTs on the Bitcoin network, or Ordinal inscriptions, have seen a notable uptick in sales. Remarkably, in November, their sales outperformed those on Ethereum and this momentum has continued into December.

Recent data indicates that Bitcoin NFT sales have reached an impressive $425.63 million this week, surpassing Solana’s $104 million and Ethereum’s $79.98 million over the same period.

Market Dynamics and Leading Collections

Currently, Okx, Unisat, and Magic Eden are leading the charge in the market for Bitcoin-based NFTs. As of December 20, 2023, Okx dominates with over 85% market share. Unisat and Magic Eden follow, with shares of 8.3% and 4.3%, respectively.

In this vibrant market, the Bitcoin Frogs collection has emerged as particularly popular. Its floor price stands at 0.395 BTC, roughly $17,241. Over the past week, Bitcoin Frogs achieved sales of 193.26 BTC (about $8.43 million) on Magic Eden alone. Across various platforms, the collection’s sales reached 328.95 BTC, or $14.35 million.

Other notable collections this week include bitmap, early sub-100K Ordinals, MNCHRMS, Bitcoin Punks, Ordinal Maxi, Fuzzy Fox, and early sub-10K Ordinals.

Comparative Market Valuations

While Bitcoin Ordinal inscription collections are quickly gaining prominence, they still trail behind some of the top Ethereum NFT collections like Cryptopunks, Bored Ape Yacht Club (BAYC), and Mutant Ape Yacht Club (MAYC) in terms of value. For instance, Cryptopunks boasts a market valuation of $1.14 billion, significantly higher than Bitcoin Frogs’ $172 million. However, the market cap of Bitcoin Frogs is more on par with BAYC, valued at $572 million, and MAYC, which has a market cap of $224 million.