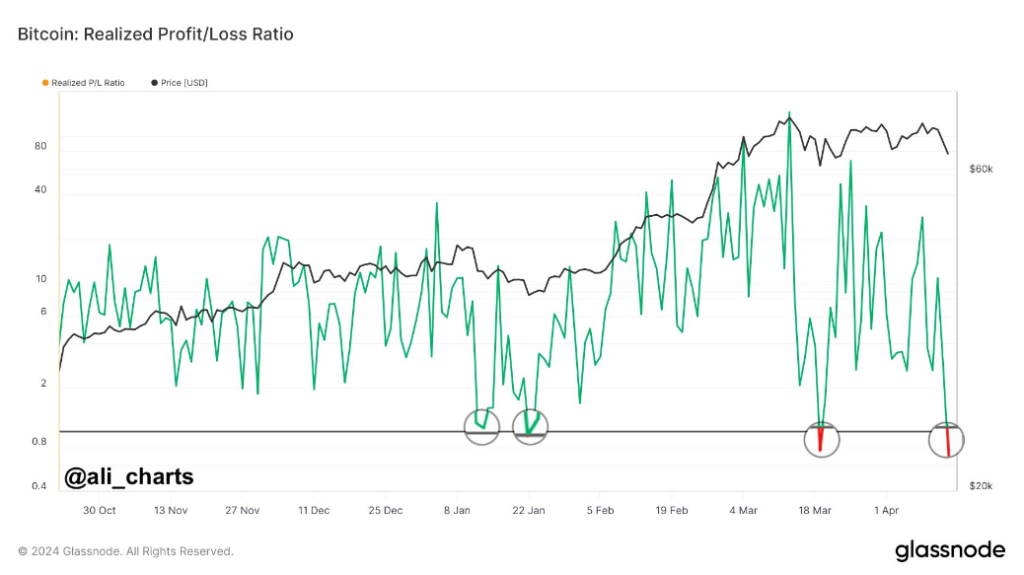

Losses Outpace Profits

Bitcoin investors are facing a bumpy ride as the digital currency’s value fluctuates. Data shows that investors are currently losing more money than they’re making. This is a significant shift from the recent past, where profits dominated.

Rollercoaster Ride

Bitcoin’s price has been on a rollercoaster over the past 24 hours. It dropped to $64,000 before rebounding to $66,000. This volatility has left investors uncertain about the future.

Institutional Interest Grows

Despite the price decline, institutional interest in Bitcoin continues to grow. The approval of a spot Bitcoin ETF in Hong Kong could bring more capital into the market.

Regional Dynamics

Investor sentiment varies across different regions. Some are cautious due to volatility and geopolitical uncertainty, while others see Bitcoin as a hedge against inflation.

Critical Support Level

Analyst Willy Woo has identified $59,000 as a critical support level. If Bitcoin falls below this, it could signal a bearish market.

Anticipated Short Liquidations

Investors are anticipating potential short liquidations that could drive the price higher. However, this depends on market liquidity and investor reactions.

Cautious Optimism

Despite the uncertainty, investors remain cautiously optimistic about Bitcoin’s long-term prospects. The upcoming halving event could add to the volatility, but it could also lay the groundwork for a sustainable recovery.