Market analysis firm Glassnode reveals a key reason why Ethereum (ETH) has fallen behind Bitcoin (BTC) in the recent market cycle.

New Buyer Interest

Glassnode notes that Ethereum has not attracted the same level of capital from new buyers as Bitcoin. This influx of new capital has driven Bitcoin to record highs.

Bitcoin ETF Approval

The analysts attribute the surge in Bitcoin’s short-term holders to the approval of spot Bitcoin exchange-traded funds (ETFs). These ETFs have increased speculative activity and capital accumulation among short-term holders.

Ethereum’s Underperformance

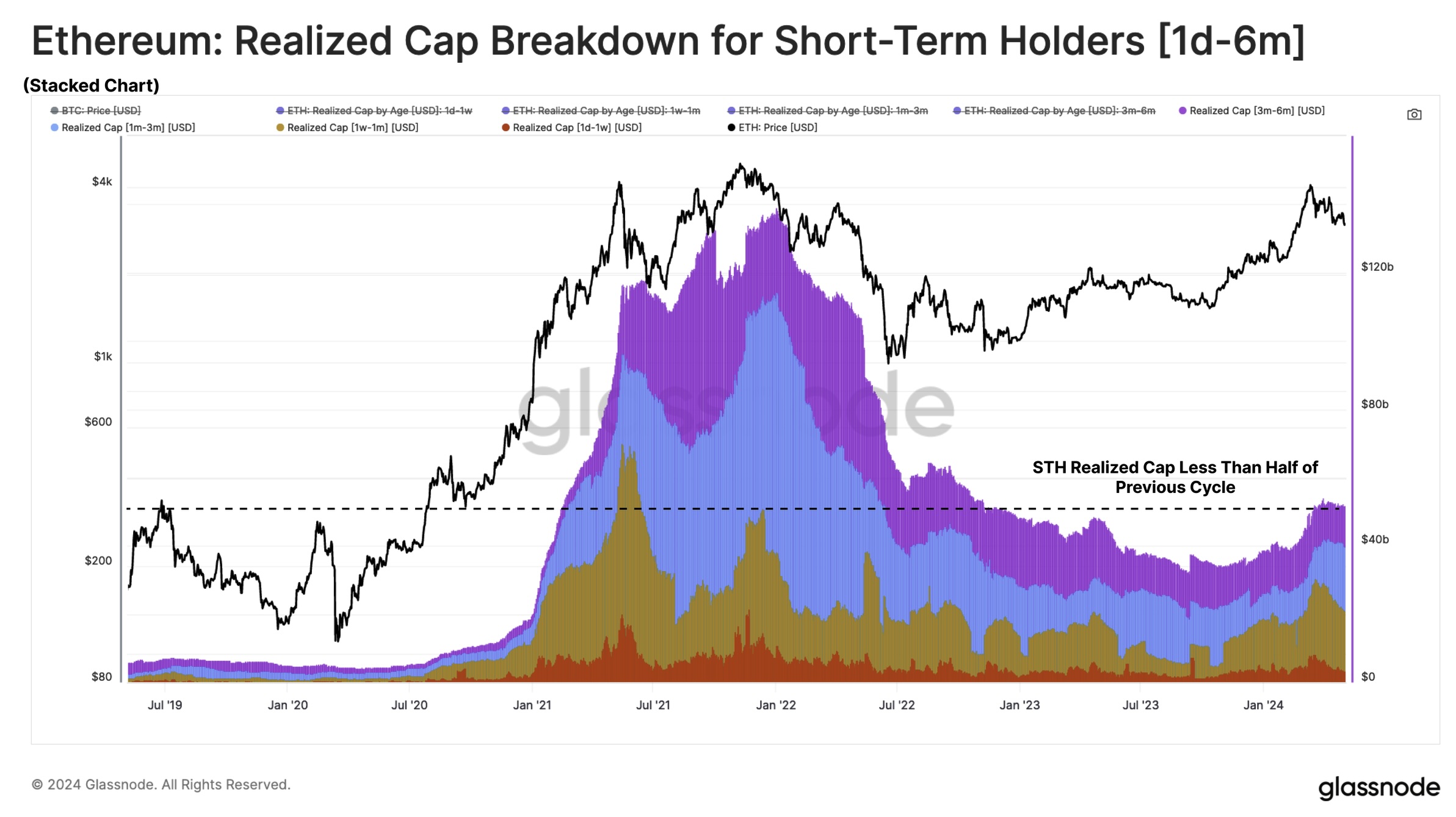

In contrast, Ethereum’s short-term holder capital has remained low, indicating a lack of new capital inflows. This underperformance is likely due to the attention and access brought by Bitcoin ETFs.

Realized Cap Metric

The Realized Cap metric shows that Bitcoin’s short-term holder capital is almost at its previous bull run peak, while Ethereum’s has barely recovered. This suggests a lack of new capital inflows into Ethereum.

Potential Ethereum ETF Approval

The analysts speculate that Ethereum could see a significant capital inflow if the SEC approves spot Ethereum ETF applications later this month. However, this is still subject to regulatory approval.