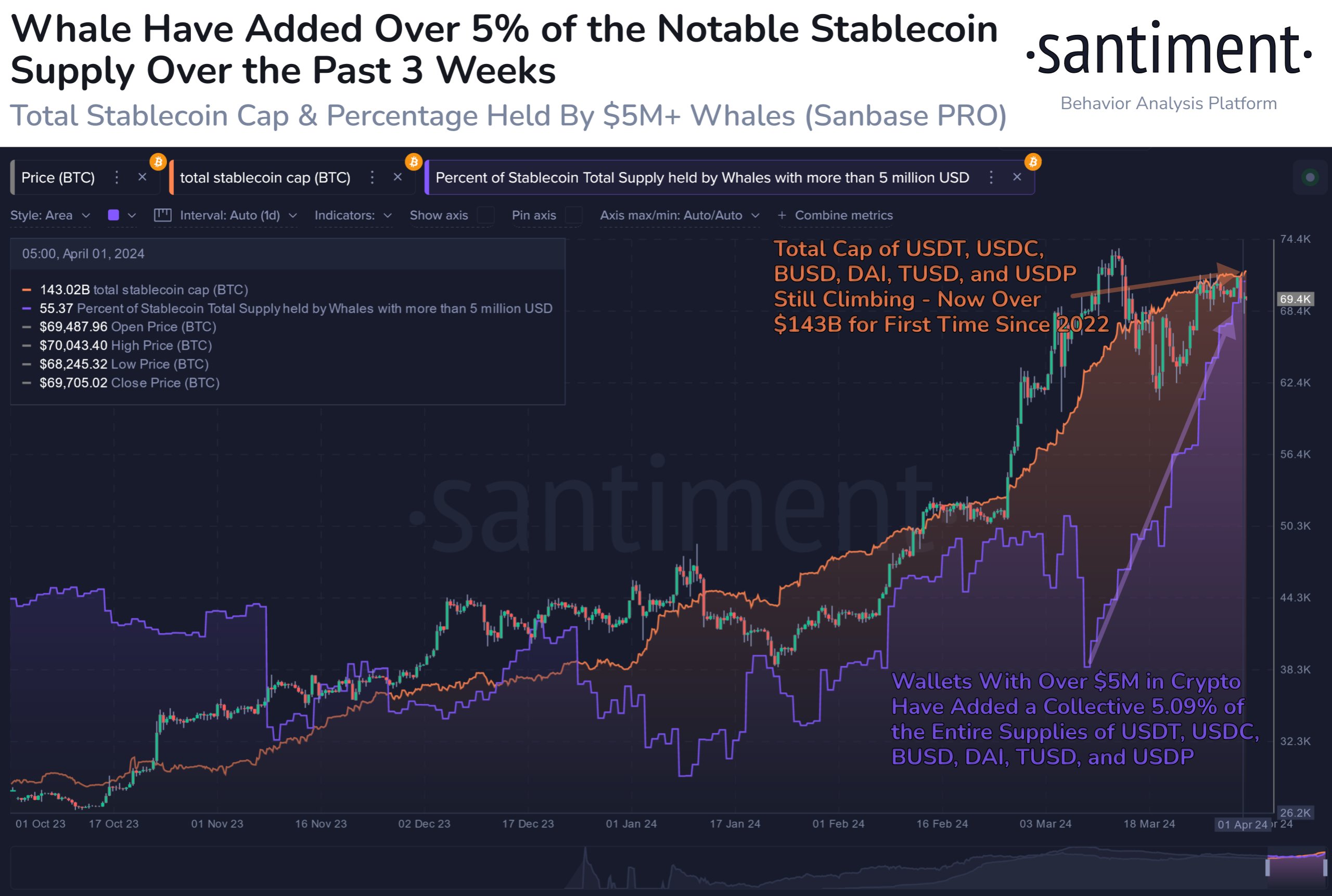

Whale Buyout

According to data from Santiment, whales (investors with at least $5 million in crypto) have been rapidly buying up stablecoins. Over the past three weeks, they’ve acquired around 5% of the supply of major stablecoins like Tether (USDT), USD Coin (USDC), and Dai (DAI).

Reasons for Accumulation

There are two possible reasons for this whale accumulation:

- New Money Inflow: Whales may be bringing new funds into the crypto market through stablecoins.

- Safety Seeking: Whales may be selling volatile cryptocurrencies like Bitcoin and moving their money into dollar-pegged stablecoins for safety.

Implications for the Market

If the accumulation is due to new money inflow, it’s bullish for the crypto sector, indicating fresh capital is entering. However, if whales are selling other cryptocurrencies for stablecoins, it could initially be bearish.

But typically, investors in stablecoins eventually plan to re-enter the volatile crypto market. So, the increase in whale holdings of stablecoins could be a sign of potential future investments in Bitcoin and other cryptocurrencies.

Bitcoin Accumulation

Santiment also notes that whales have been accumulating Bitcoin recently. This suggests that the stablecoin accumulation is not just a shift from Bitcoin to stablecoins, but rather an influx of new capital.

Bitcoin Price

Bitcoin’s price has recently dropped to around $65,200.