Bitcoin is revolutionizing the way we think about money. It offers a peer-to-peer network for transferring funds without relying on financial institutions. However, when it comes to trading, we still need to go through trusted third parties, which can be a security risk.

The Problem with Centralized Exchanges

Centralized exchanges are inherently insecure because they pool funds together without any oversight. This can lead to bankruptcies and losses for end users.

Bitcoin as a Technical Infrastructure

Bitcoin’s code consists of operations that can be assembled to form scripts. These scripts can be used to create complex applications, such as the Lightning Network and Discreet Log Contracts (DLCs).

DLCs: The Key to Trustless Trading

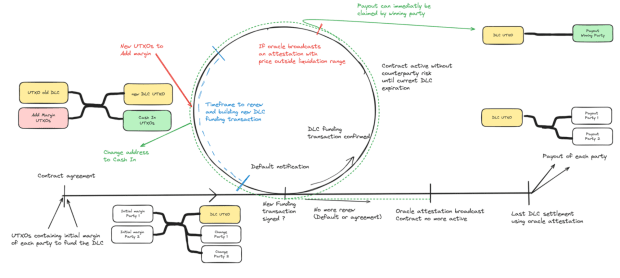

DLCs are native “smart contracts” built on Bitcoin. They enable the delivery of a payoff depending only on the publication of a price by an oracle. This means that DLCs can be used to create trustless trading platforms.

DLC Markets: A Trustless OTC Derivatives Trading Platform

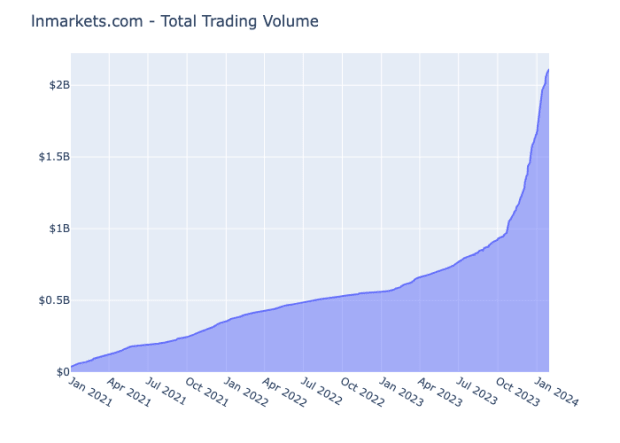

DLC Markets is a trustless OTC derivatives trading platform designed to meet the needs of crypto financial institutions. It allows for the trading of various financial instruments, including Bitcoin futures and options, with almost no counterparty risk.

How DLC Markets Works

DLC Markets uses a unique approach with a coordinator to solve the free-option dilemma when the DLC is initiated. This approach also makes it possible to integrate margin calls, liquidation, and netting in the DLC process.

The Future of Derivatives Trading

DLC Markets represents a paradigm shift in derivatives trading. It offers a trustless and secure alternative to the centralized exchanges that have long dominated the financial sector.

Join the Beta

You can sign up to try out the DLC Markets Beta. The platform has completed a $3 million seed round led by ego death capital, along with Lemniscap and Timechain.

More Information

Visit the LN Markets website and the DLC Markets website for more information.

Note: This is a guest post by LN Markets. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine./p>