Distribution to New Investors

According to Glassnode, long-term Bitcoin (BTC) holders are selling their coins to new investors entering the market. This trend is driven by Bitcoin’s recent price surge, which has encouraged profitable holders to distribute their wealth to newer investors.

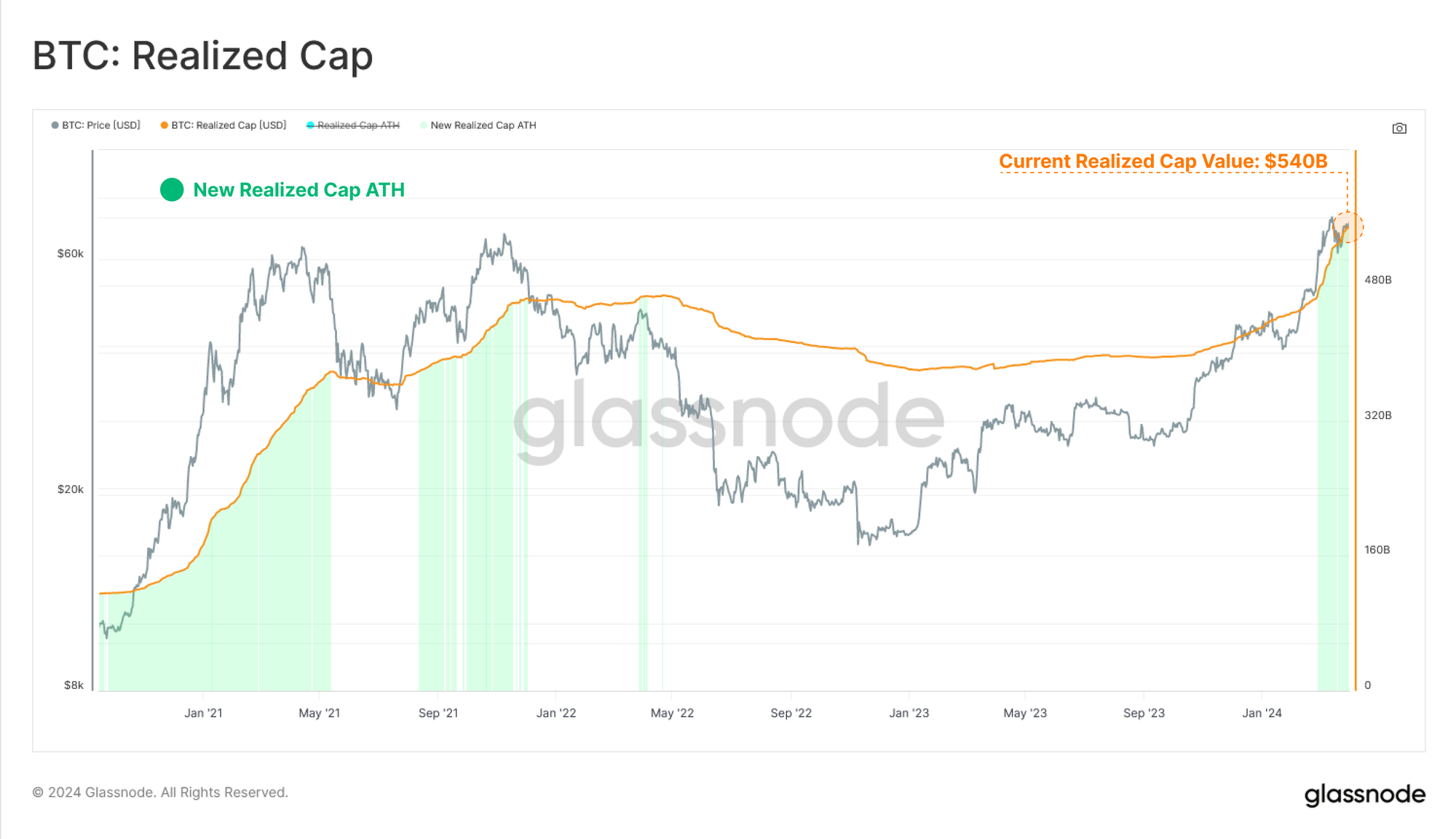

Realized Cap at Record High

Glassnode’s Realized Cap metric, which tracks the price at which each coin was moved, indicates that most holders are currently in profit. This has led to a significant injection of fresh demand and liquidity into the market, as spent coins are revalued from a lower cost basis to a higher one.

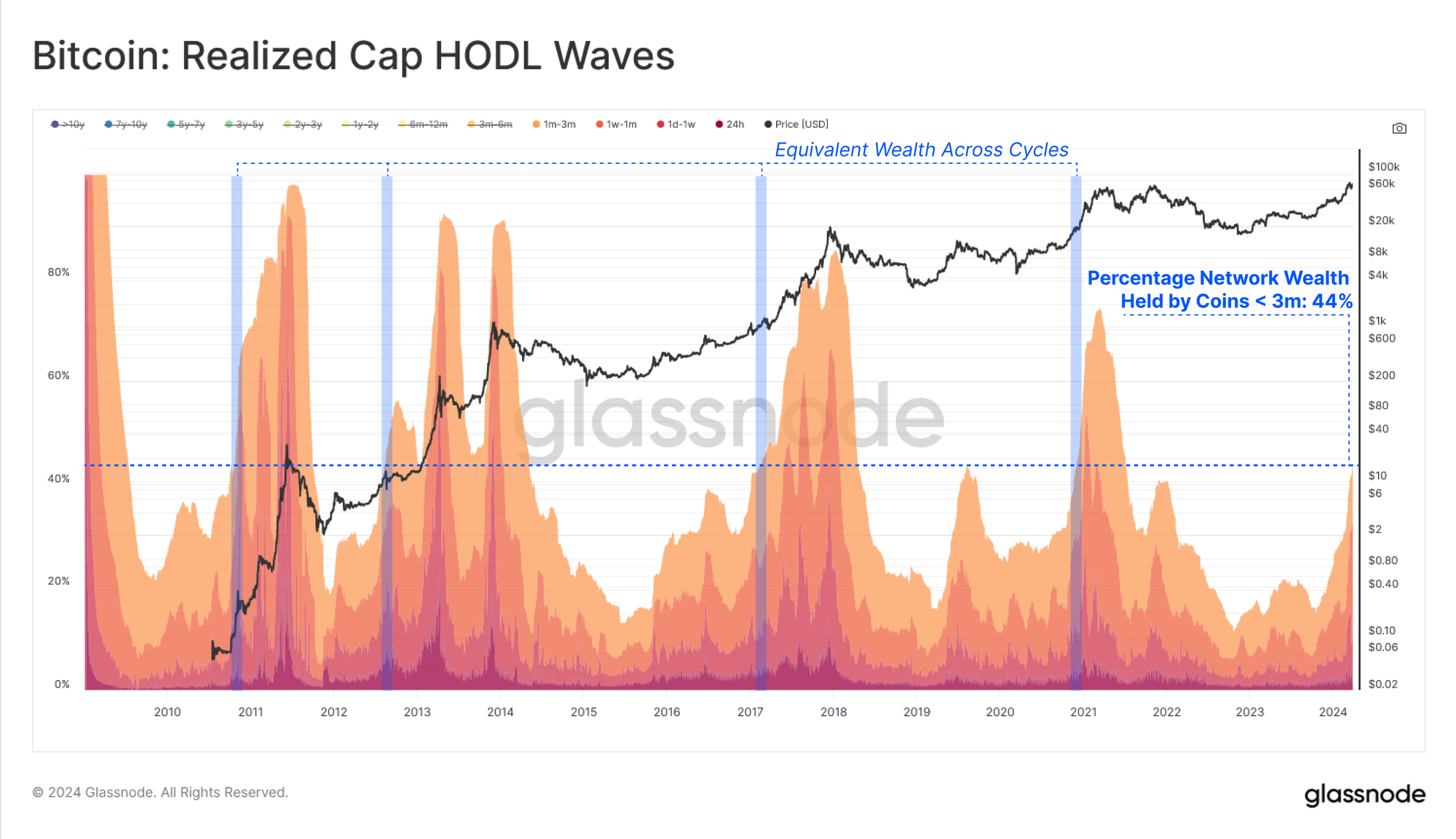

44% of BTC Held by Newcomers

Data from Glassnode shows that 44% of all BTC in circulation is now held by addresses that have been holding for less than 3 months. This increase in younger coins is a result of long-term holders selling their coins at higher prices to meet the demand from new investors.

Bullish Signal

Historically, when the percentage of coins held by younger addresses crosses above 44%, it has coincided with mid-stage bull markets. This suggests that the current trend is a bullish signal for Bitcoin.

Current Price

At the time of writing, BTC is trading at $65,004, approximately 18% below its all-time high.