Optimism (OP) emerges as a Layer 2 solution to Ethereum’s age-old scalability woes, delivering users lower fees and quicker transactions. Ethereum, in prioritizing security and decentralization over scalability, faces challenges that have led to the rise of various Layer 2 solutions, with Optimism being a noteworthy contender.

Ethereum’s Gas Fee Evolution

In the earlier days, minimal ETH gas fees were inconsequential given the lower value of ETH. However, as ETH’s value surged, users found themselves shelling out substantial amounts, upwards of $80, for a single Ethereum chain transaction.

Optimism Network: Bridging the Scalability Gap

Optimism, a Layer 2 Ethereum rollup, stands out with its promise of cost-effective gas fees and rapid transaction speeds. Utilizing the Optimism chain for transactions proves to be a refreshing experience, especially for those accustomed to Ethereum’s hefty gas fees.

Getting Started with Optimism (OP) Network

To dive into the Optimism ecosystem, it’s crucial to understand how to acquire and use optimism ETH (opETH). Notably, the Optimism mainnet chain employs opETH for gas fees, while tokens on the chain adopt the opX nomenclature, with X representing the specific token.

Acquiring opETH: Centralized and Decentralized Approaches

For those seeking a centralized route, platforms like Binance, Bybit, Kucoin, or HTX offer a straightforward method. Alternatively, the decentralized path involves using compatible EVM wallets such as Metamask, Trustwallet, Coinbase Web 3 wallet, among others.

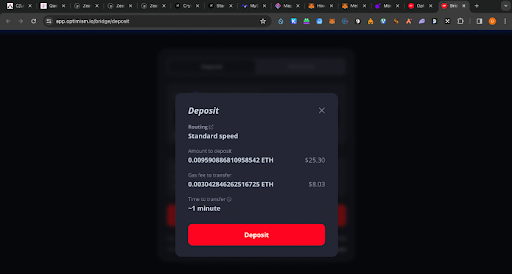

Bridging to Optimism Network: A Step-by-Step Guide

To bridge to the Optimism network, one must first have a compatible EVM wallet and Ethereum in hand. The process involves using either native ETH or other Layer 2 ETH, with various bridging options explored, each having its associated fees and considerations.

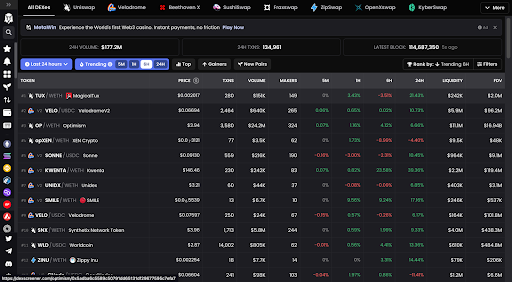

Trading on the Optimism Chain: A Dexscreener Exploration

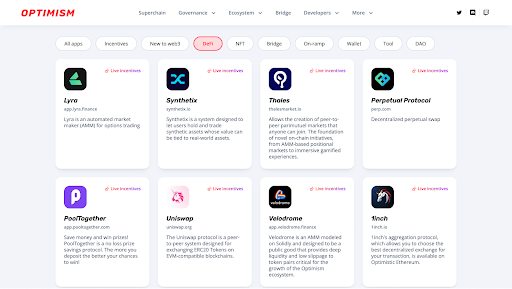

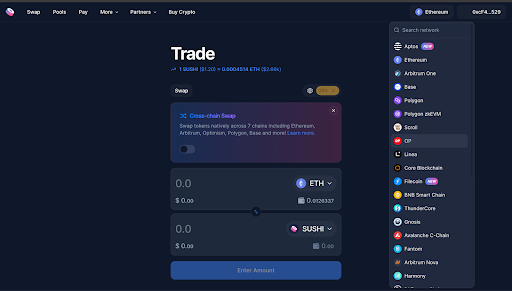

Once armed with optimism ETH, the next step is trading. Dexscreener proves invaluable for discovering tokens on the Optimism chain, with users able to search by token name or smart contract address. Various decentralized exchanges (DEXes) like Uniswap, 1INCH, and Sushi Swap facilitate trading, with a walkthrough provided for SushiSwap.

Conclusion: Navigating Risks in the Optimism Network

While the Optimism network offers a more affordable Ethereum experience, users must exercise caution. Trading tokens on decentralized exchanges comes with unique risks, given the novelty of many listed tokens. It’s crucial to only risk what one is willing to lose and conduct thorough research before delving into the decentralized trading landscape.