Bitcoin Halving: A Periodic Cut in Block Rewards

Bitcoin has recently undergone its fourth halving, where block rewards for miners are halved. This event occurs every four years and reduces rewards from 6.25 BTC to 3.125 BTC.

Miner Revenue Sources

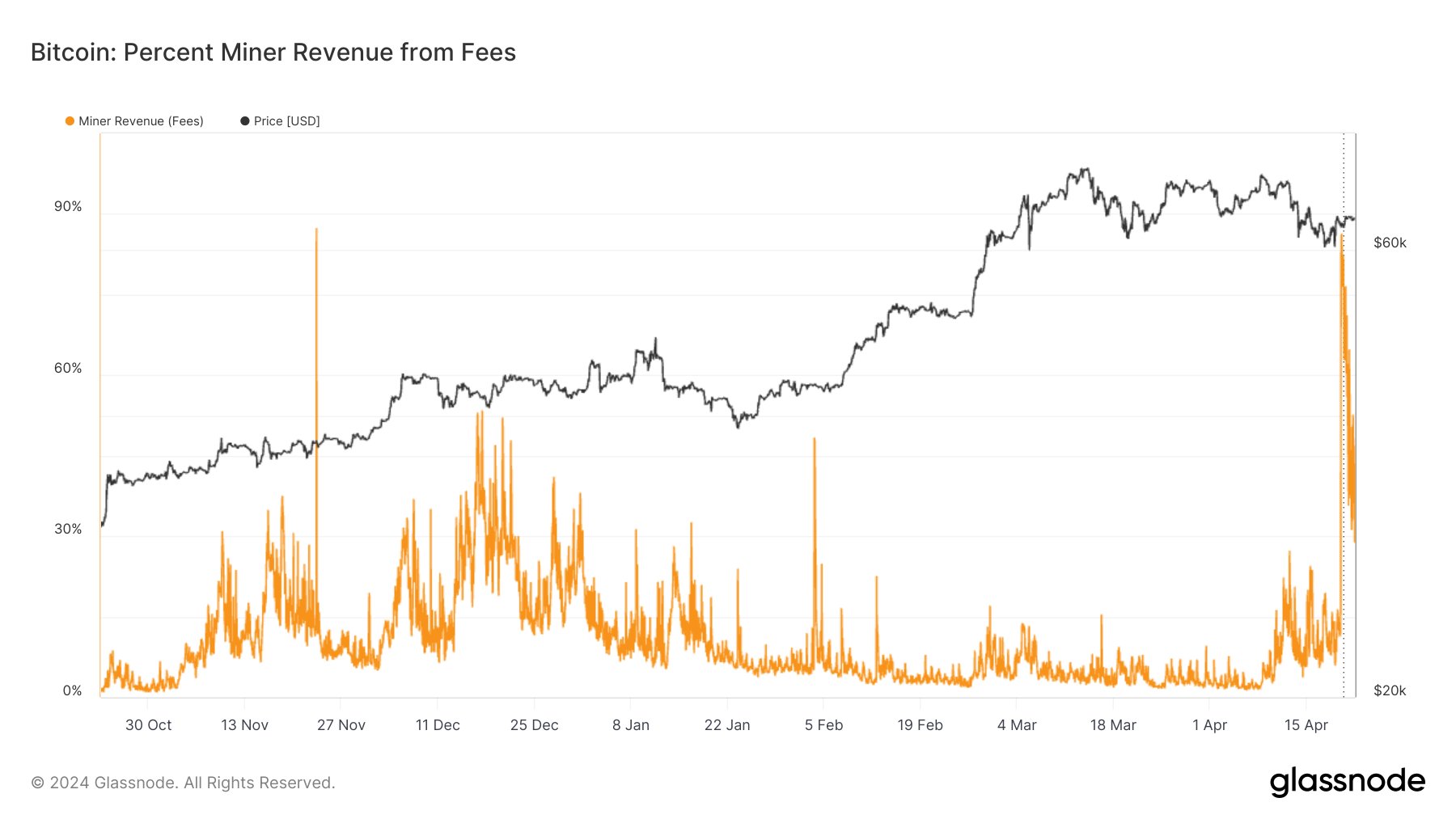

Miners earn revenue from block rewards and transaction fees. Block rewards have historically been the primary income source.

Hashrate as an Indicator of Miner Sentiment

Hashrate measures the computing power connected to the Bitcoin network. Changes in hashrate reflect miner sentiment. A rising hashrate indicates miners find the blockchain attractive, while a decline suggests some miners are leaving.

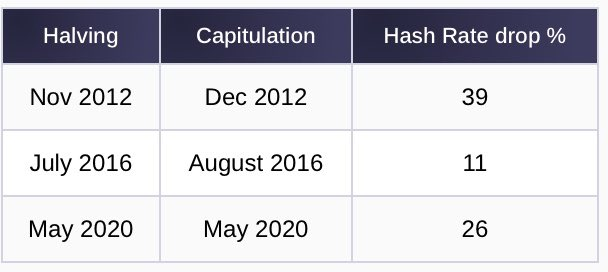

Hashrate Trends Post-Halving

Historically, hashrate has declined after halving events. However, this time, the 7-day average Bitcoin hashrate set a new all-time high on the day of the halving.

Reasons for High Hashrate

Miners may not be concerned about the halving or may have rushed to earn higher block rewards before they ended. However, the hashrate has declined slightly since then, suggesting some miners have left.

Transaction Fees Boosting Miner Revenue

Despite the halving, transaction fees have surged due to the introduction of Runes, a protocol for creating tokens on the Bitcoin network. This has increased miner revenue from fees, potentially keeping them active post-halving.

Bitcoin Price

At the time of writing, Bitcoin is trading at around $66,100, up over 3% in the past week.