Skip to content

- Home

- News

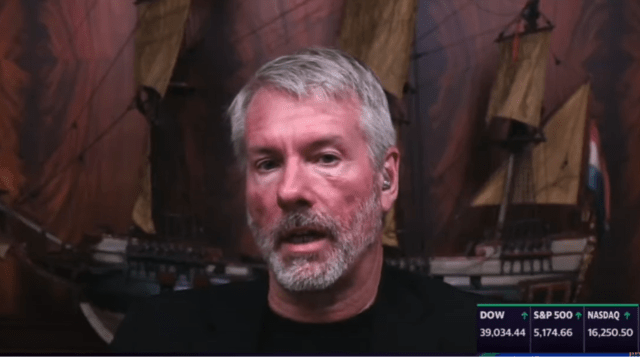

- MicroStrategy’s Bitcoin Focus and Massive BTC Holdings

Bitcoin ETFs Drive Unprecedented Demand

- Bitcoin’s value surged to a 26-month high due to the introduction of Bitcoin spot exchange-traded funds (ETFs).

- ETFs have increased Bitcoin’s popularity as a unique, global, and non-correlated digital asset.

- Demand for Bitcoin through ETFs is outstripping supply, leading to a 13% growth in the past 30 days.

MicroStrategy’s Bitcoin Stash Hits $9 Billion

- MicroStrategy rebranded as a Bitcoin development company, focusing on software development, cash flow generation, and Bitcoin accumulation.

- The company’s Bitcoin holdings surpassed $9 billion, owning approximately 190,000 Bitcoins.

- MicroStrategy’s Bitcoin investment journey began in 2020 with a $250 million purchase and has consistently increased since then.

MicroStrategy’s Bitcoin Holdings: A Detailed Look

- MicroStrategy acquired 190,000 BTC at an average cost of $31,224 per Bitcoin, totaling $5.93 billion.

- As of writing, Bitcoin is trading at $48,740, showing a 1.6% decrease in the past hour.

- The cryptocurrency reached a high of $50,200 on Monday, with a 13% upward trend over the past seven days.

Uncertain Future of Index Funds

- The impact of index funds on institutional and retail investors is uncertain.

- The ongoing rise in demand for Bitcoin may continue to attract and captivate investors.