As we bid farewell to a bullish December and a crypto-packed year, let’s dive into what January 2024 holds for the crypto realm, with our attention squarely on Chainlink (LINK), BNB, and Ethereum’s layer-2 scaling solutions.

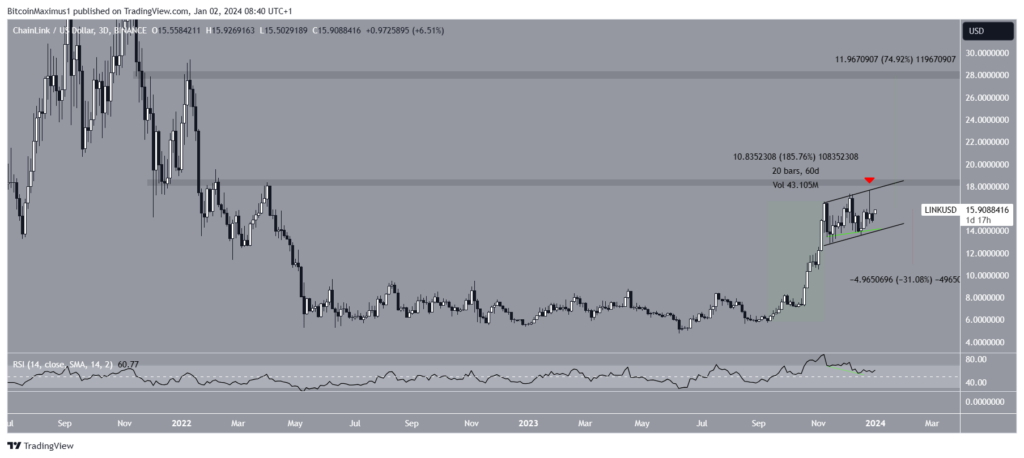

LINK: Aiming for the Stars Again

LINK had its moment in the spotlight, soaring by a staggering 200% in September and October 2023. While the momentum has eased, LINK remains in an ascending parallel channel, hitting a high of $17.67 on December 28. Despite a slight stumble, the Relative Strength Index (RSI) flashes a bullish signal, staying above 50 with an upward trajectory and a hidden bullish divergence. The resistance trend line sits at $18.50, a crucial point. If breached, a potential 75% surge to $28 awaits.

But beware, a channel breakdown could see LINK drop by 30% to find support at $11.

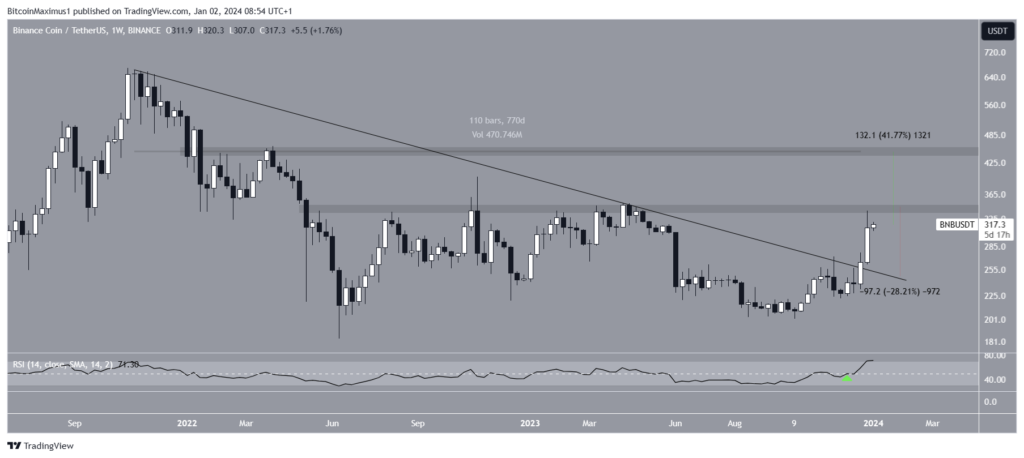

BNB: Breaking Barriers Above $400

Since its October 2023 low of $202, BNB has been on the upswing, breaking free from a 770-day descending resistance trend line. Currently at $320, the Weekly RSI’s green light above 50 indicates validation. Facing resistance at $345, a breakthrough could catapult BNB by over 40% to $450.

However, a robust rejection at $345 might trigger a 30% slide to find support at $245.

ARB and MATIC: Scaling the Heights

The latter part of 2023 saw Solana and its ecosystem soar, possibly impacting Ethereum’s liquidity. January might bring relief through layer-2 scaling solutions ARB and MATIC.

ARB is poised for a 45% surge if it clears the final resistance at $1.70, nearing its all-time high. On the other hand, MATIC’s bullish stance, breaking a 740-day descending resistance trend line, hints at a 50% climb to $1.55.

While optimism prevails, caution is advised. Failure to sustain above $1.70 for ARB and the descending resistance trend lines for MATIC could lead to a 30% dip for both. As the crypto rollercoaster continues, January promises both excitement and potential pitfalls in the ever-evolving landscape.

For BeInCrypto’s latest crypto market analysis, click here.