Fred Krueger, a crypto investor, believes Ethereum is overvalued at current prices. He refers to Ethereum’s declining on-chain activity, competition from alternatives like Solana and Avalanche, and regulatory uncertainty as reasons for its high valuation.

Ethereum’s Challenges

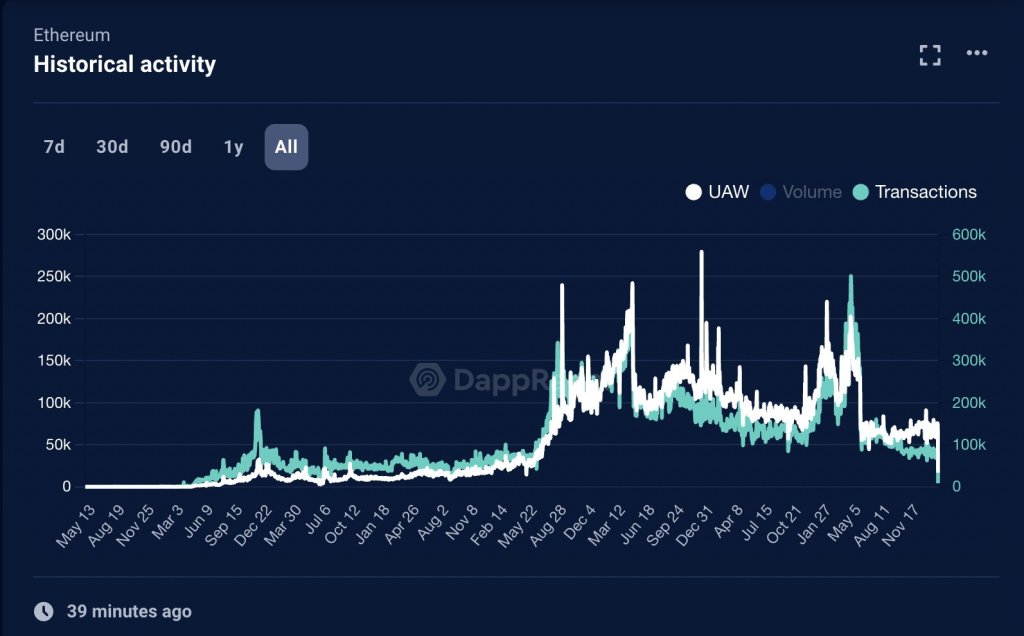

Krueger argues that Ethereum’s on-chain transactions are slow and expensive compared to scalable and low-fee alternatives. He also points to the sharp decline in daily active users (DAUs) on the Ethereum mainnet, from around 120,000 in 2021 to approximately 66,000 in February 2024.

Comparison with Alternatives

Krueger believes that faster and cheaper alternatives like Solana, Avalanche, and Near Protocol offer better value for specific use cases like decentralized finance (DeFi) and games. He also notes that these alternatives have seen growth in their user bases, while Ethereum’s has declined.

Regulatory Uncertainty

Krueger also expresses concern about the lack of regulatory clarity on Ethereum. The United States Securities and Exchange Commission (SEC) has approved the first spot Bitcoin exchange-traded funds (ETF) batch, but it has not yet classified ETH in the same category as BTC. This uncertainty, according to Krueger, makes holding Ethereum risky.

Conclusion

Despite criticism, Ethereum supporters remain optimistic about its future. They believe that rising adoption and ETH’s deflationary nature will lift prices towards 2021 highs of $5,000. However, Krueger believes that Ethereum’s valuation is unsustainable and that it is likely to decline in the coming months.