Former Treasury Secretary Larry Summers has raised concerns about the accuracy of the official inflation rate, suggesting it may be significantly underestimating the true pain Americans are facing.

Pre-1983 Inflation Measure Reveals Spike

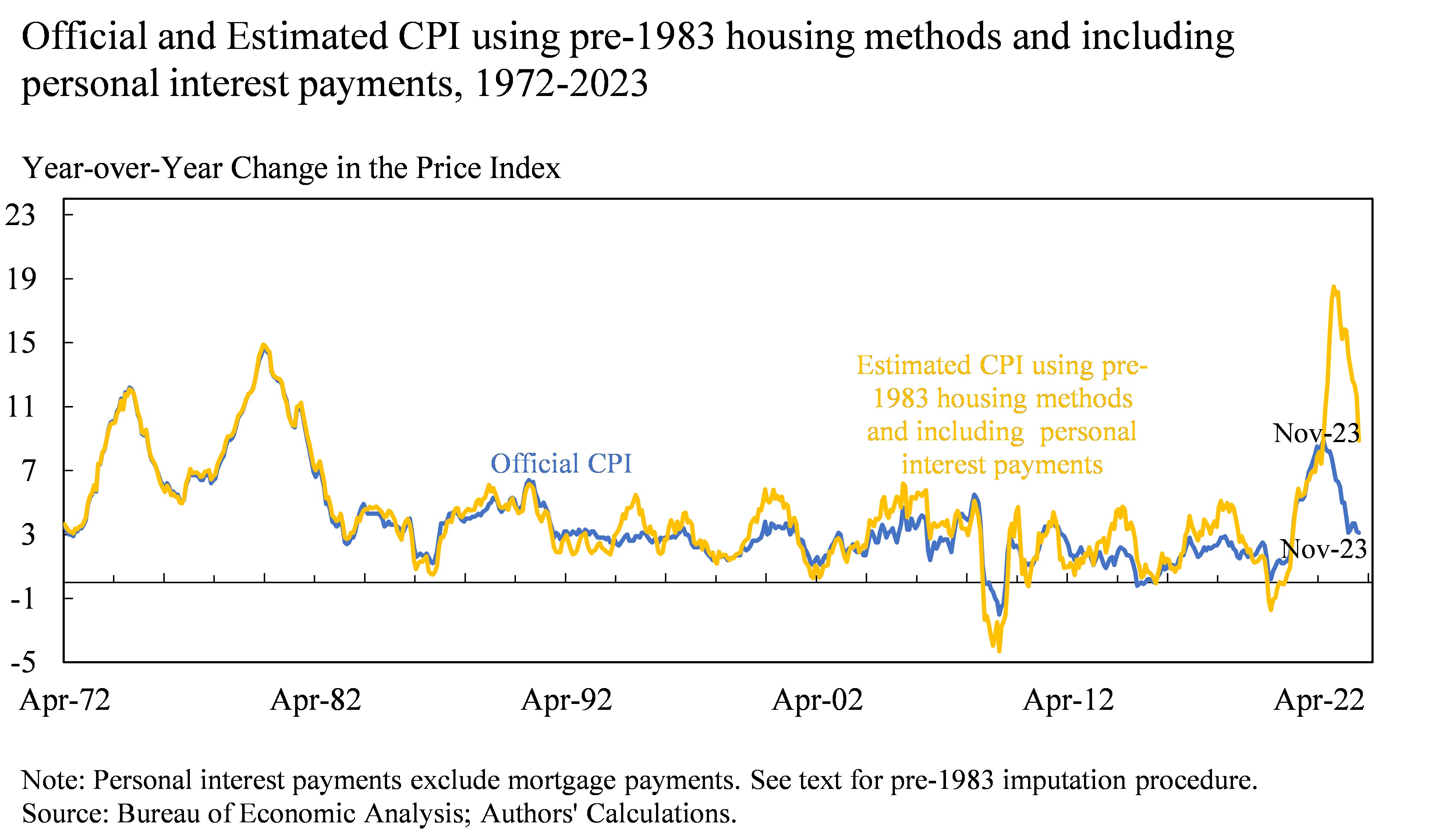

Using an older method of measuring inflation that included personal interest rates and housing financing costs, Summers and co-authors found that inflation in November 2022 spiked to around 18%, compared to the official government figure of 4.1%.

Official Inflation Underestimates Impact

Summers explains that when interest rates rise, as they did last year, the official inflation index does not fully capture the impact on consumer well-being. This is because the index no longer includes borrowing costs.

Personal Interest Payments Soar

Personal interest payments, which are not included in the government’s CPI system, increased by over 50% in 2023. This has created a “deeply felt pain point” for consumers.

Housing Market in Stasis

The higher cost of borrowing has also led to a “lock-in” state in the housing market. Homeowners are reluctant to sell due to potentially higher mortgage payments on their next home, while underwhelming price drops are not enticing new buyers.

Discrepancy Between Official Numbers and Everyday Expenses

The revelation that inflation may be much higher than reported could explain the discrepancy between the official numbers and the soaring cost of everyday expenses like groceries and housing.

Paper Highlights Consumer Sentiment Anomaly

Summers and his co-authors have published a paper titled “The Cost of Money is Part of the Cost of Living: New Evidence on the Consumer Sentiment Anomaly.” The paper argues that the official inflation numbers do not fully capture the impact of higher borrowing costs on consumer sentiment.