Fidelity’s Game-Changing Move

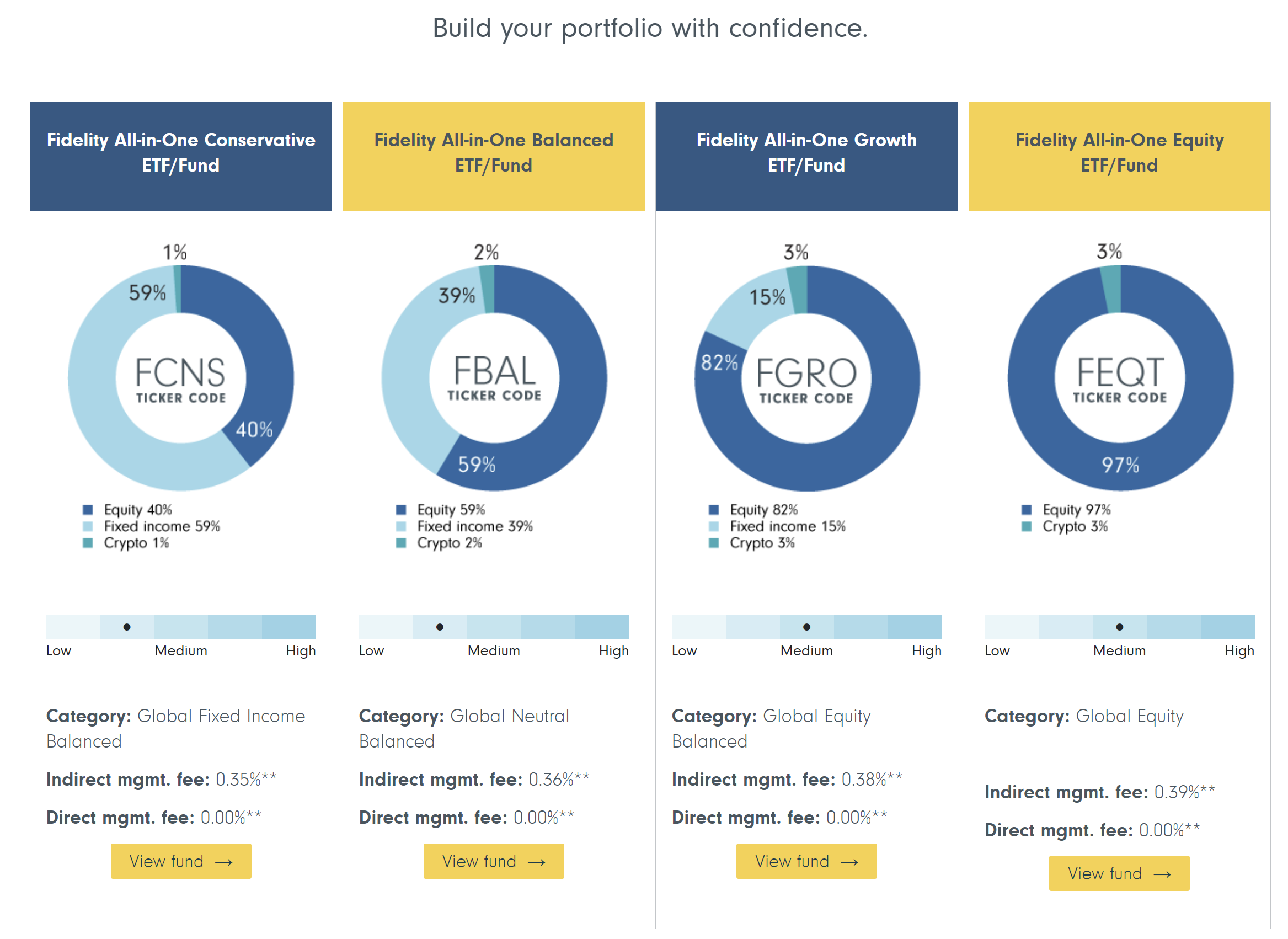

Fidelity Investments, a financial giant with over $12.6 trillion in assets, has made a bold move by recommending a 1-3% allocation to Bitcoin in traditional portfolios. This groundbreaking decision is expected to attract hundreds of billions of dollars into the cryptocurrency market.

Experts Predict Bitcoin’s Future

Matt Ballensweig, Head of Go Network at BitGo:

“Fidelity’s recommendation is a catalyst for multi-trillion dollar asset managers to sell Bitcoin through their vast distribution channels.”

Will Clemente III, Renowned Analyst:

“Fidelity’s move is a gateway drug. As more investors allocate to crypto, the demand will surge.”

Implications for Bitcoin’s Price

Adam Cochran, Partner at CEHV:

“The inclusion of crypto in traditional portfolios could lead to a substantial reevaluation of Bitcoin’s value.”

Cochran predicts that the influx of funds from traditional investments could drive Bitcoin’s price to $750,000. He draws parallels to the exponential growth of the internet, suggesting that the crypto market could follow a similar trajectory.

Conclusion

Fidelity’s recommendation is a major turning point for the crypto industry. It signals the growing acceptance of cryptocurrencies as legitimate investments and could pave the way for a significant increase in Bitcoin’s price.