Ethereum, the second-largest cryptocurrency, has been struggling lately. Its price has been stuck below $2,400, and its daily revenue has dropped to levels last seen in May 2020.

Why the Revenue Drop?

“Revenue” in this case refers to the fees paid to validators who process transactions on the Ethereum network. The drop in revenue is likely due to a combination of factors:

- Lower Gas Fees: Ethereum has been working on reducing gas fees, the cost of transactions, for a while now. This has made it more affordable for users, but it also means less revenue for validators.

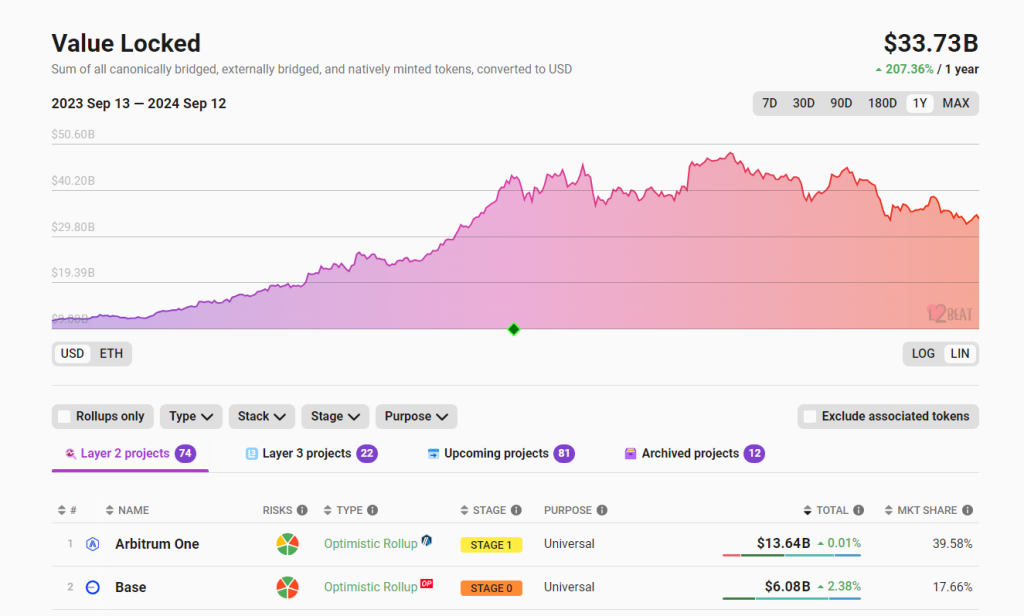

- Layer-2 Solutions: Ethereum’s layer-2 solutions, like Arbitrum, OP Mainnet, and Base, are gaining popularity. These platforms process transactions off-chain, reducing the load on the Ethereum mainnet and further lowering gas fees.

Why Ethereum’s Future is Still Bright

Despite the revenue drop, many analysts believe that Ethereum’s future is still bright. Here’s why:

- Scaling Success: The success of layer-2 solutions is a major win for Ethereum. They have significantly improved scalability, making the network more accessible to users.

- Continuous Development: Ethereum is constantly being developed and improved. The upcoming “Purge to Splurge” phases will eventually lead to Sharding, a technology that will allow Ethereum to process millions of transactions per second without relying on layer-2 solutions.

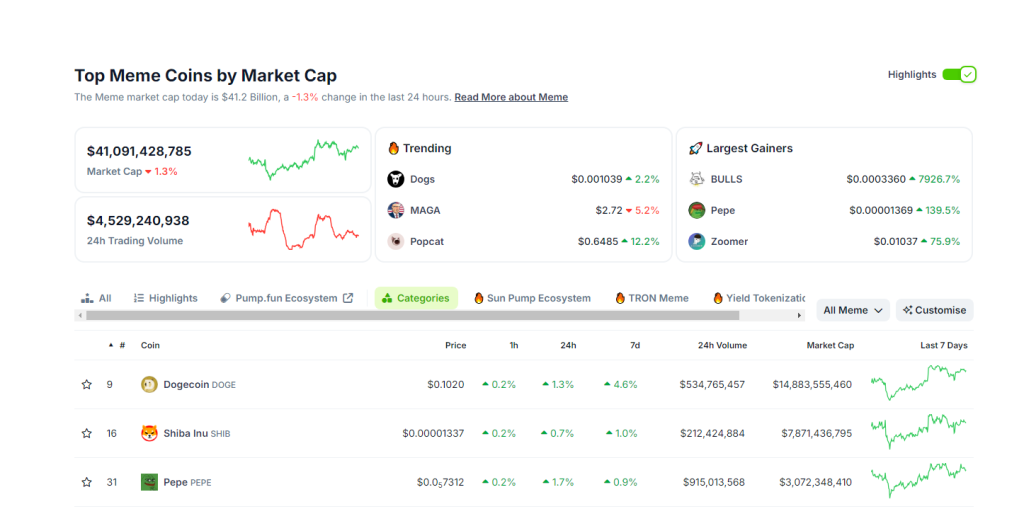

- Meme Coin Activity: Ethereum remains a popular platform for meme coins, with some of the most valuable ones like Pepe and Floki residing on the network. This shows that developers and users still see Ethereum as a viable and exciting platform.

The Bottom Line

While Ethereum’s revenue has taken a hit, this doesn’t mean the network is failing. The focus on scalability and continuous development suggests that Ethereum is well-positioned for future growth.