Bullish Momentum: Staking and ETF Surge

Ethereum (ETH) is on the rise, edging closer to the $3,000 mark. Several factors are driving this bullish sentiment:

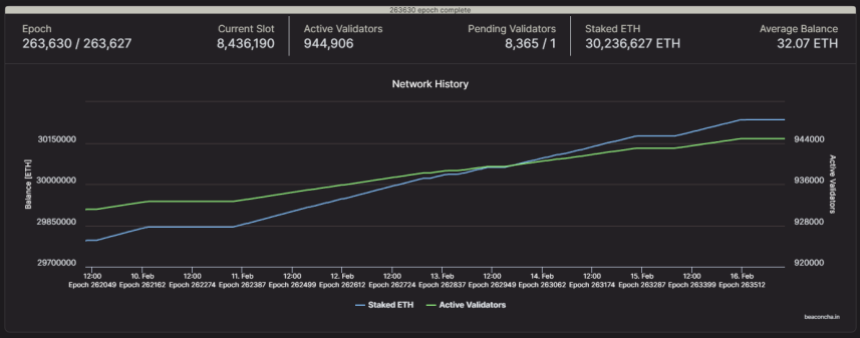

- ETH Staking Popularity: More investors are locking their ETH into staking contracts, reducing the available supply and creating upward price pressure.

- ETF Potential:

The possible approval of an Ethereum Exchange-Traded Fund (ETF) could attract institutional investors and boost demand.

The possible approval of an Ethereum Exchange-Traded Fund (ETF) could attract institutional investors and boost demand. - Network Upgrades:

The recent Dencun upgrade on the Sepolia testnet promises improved performance and lower transaction costs, attracting more developers and users.

The recent Dencun upgrade on the Sepolia testnet promises improved performance and lower transaction costs, attracting more developers and users.

Obstacles to $4,000

Despite the bullish momentum, ETH faces challenges:

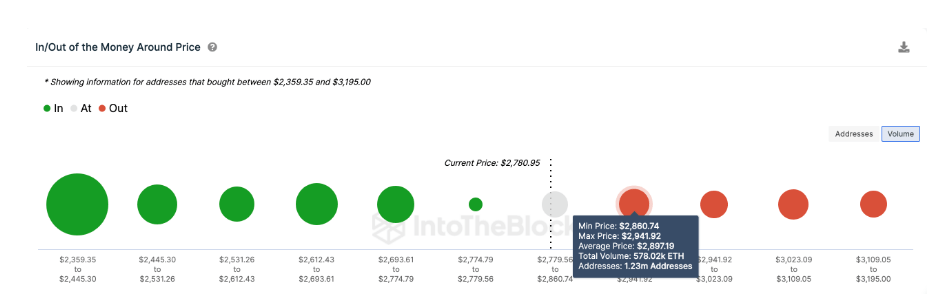

- Resistance at $2,850: A significant number of holders bought ETH at this level and may sell for profits.

- Dip Below $2,500: A price drop below this level could trigger panic selling.

- Volatility: The cryptocurrency market is inherently volatile, and ETH’s price could fluctuate significantly.

Cautious Optimism

While the short-term outlook for ETH is promising, caution is advised. Investors should assess their risk tolerance and research thoroughly before investing. The coming weeks will determine if ETH can break through the $2,850 resistance and continue its ascent towards $3,000 and beyond.