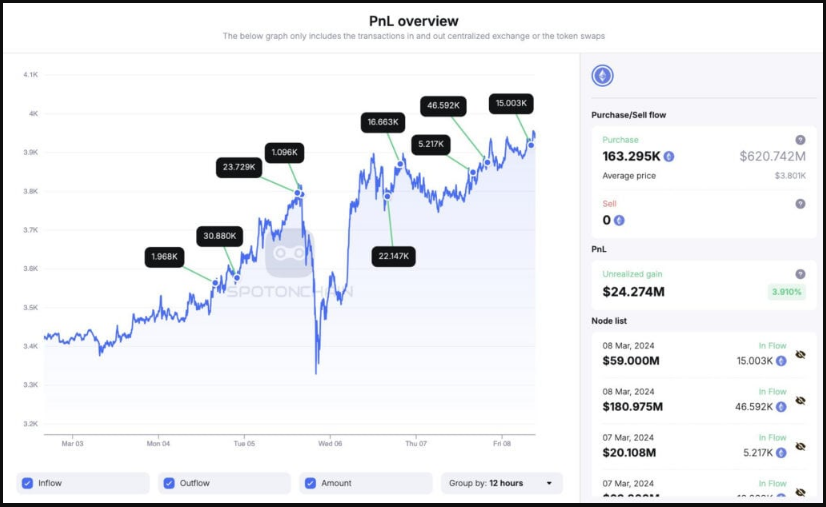

Whale Activity and On-Chain Buying

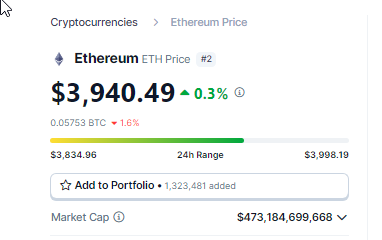

Ethereum (ETH) has seen a bullish weekend, with a 4.31% price surge in the last day. This rally is attributed to increased Ethereum accumulation by whales. Wallets linked to PulseChain and PulseX have purchased 163,295 ETH in just four days, totaling $621 million DAI. Additionally, a high whale trade volume overnight suggests major investors are accumulating ETH in anticipation of a price increase.

Profitable Investors and Approaching ATH

Over 94% of ETH addresses are currently in profit, indicating low selling pressure and potential for further price gains. ETH is at its best level in nearly a year, approaching its all-time high (ATH) of $4,890. With minimal resistance anticipated, a retest of the ATH seems likely.

Dencum Upgrade and ETF Speculation

The upcoming Dencum upgrade aims to improve scalability and reduce transaction fees on the Ethereum network. A successful upgrade could attract new investors and boost confidence in the long-term viability of Ethereum. Additionally, speculation surrounding a potential Ethereum ETF is buoying investor sentiment. An ETF would allow traditional investors to gain exposure to Ethereum without the complexities of direct ownership.

Outlook and Considerations

While the outlook for Ethereum is positive, it’s important to note that the price is still shy of its ATH. The success of the Dencum upgrade and the approval of an Ethereum ETF are not guaranteed. However, the confluence of rising on-chain activity, whale accumulation, and a profitable investor base suggests a promising future for Ethereum.