Ethereum (ETH), the second-largest cryptocurrency by market cap, has experienced a notable exodus from centralized exchanges in recent weeks. Data suggests a growing preference for holding ETH outside of trading platforms.

Ethereum Outflow Reaches $1.2 Billion

Blockchain analytics firm IntoTheBlock reported a staggering $500 million worth of ETH exiting exchanges last week, contributing to a total outflow of $1.2 billion in January. This shift raises questions about the motivations behind this trend.

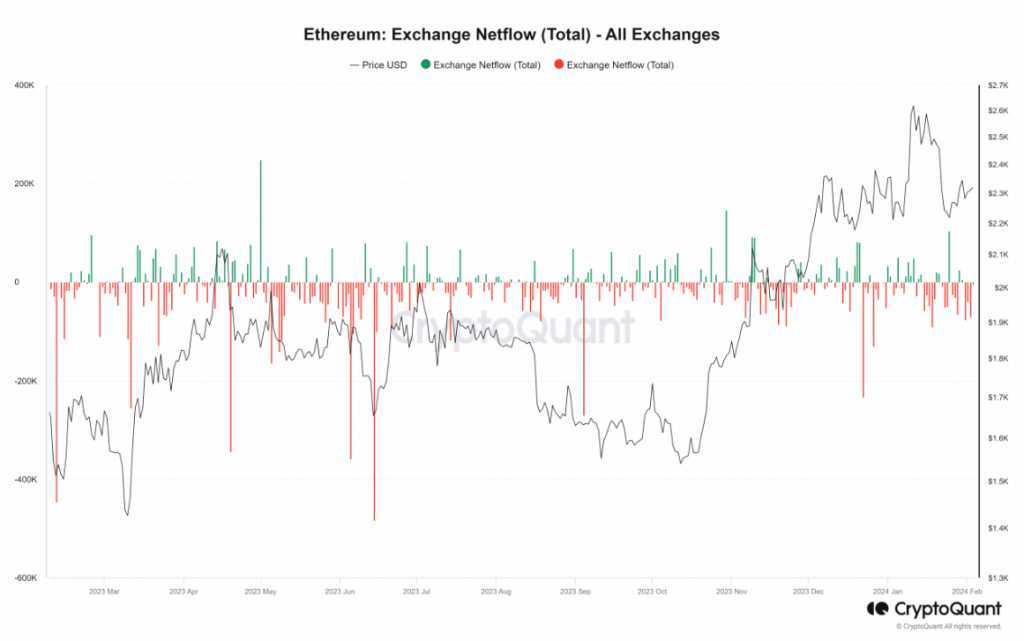

CryptoQuant Data Shows Persistent Outflows

CryptoQuant data reveals a dominant pattern of outflows since early January. Exchange holdings have consistently declined, with the last inflow recorded on January 30th. The outflow continues, with over 3,000 ETH leaving exchanges every hour.

Binance ETH Exodus: Investors’ Strategic Moves

Binance, the world’s largest cryptocurrency exchange, has witnessed a consistent decline in its ETH balance throughout January. This suggests that users are actively withdrawing their Ethereum from the platform.

Possible Interpretations

-

Increased Investor Confidence: Moving ETH off exchanges could indicate a growing sentiment among investors to hold the asset for the long term, potentially driven by confidence in its future potential. Additionally, some investors might be transferring their ETH to DeFi platforms for staking or yield farming opportunities.

-

Market Uncertainty:

The recent outflows could also reflect broader concerns about market volatility or potential regulatory changes, prompting investors to seek safer storage for their holdings.

The recent outflows could also reflect broader concerns about market volatility or potential regulatory changes, prompting investors to seek safer storage for their holdings. -

Binance-Specific Dynamics: The decline on Binance might be due to factors specific to the exchange, such as user preferences for alternative platforms or changes in its trading fees or policies.