Large Ethereum Outflows

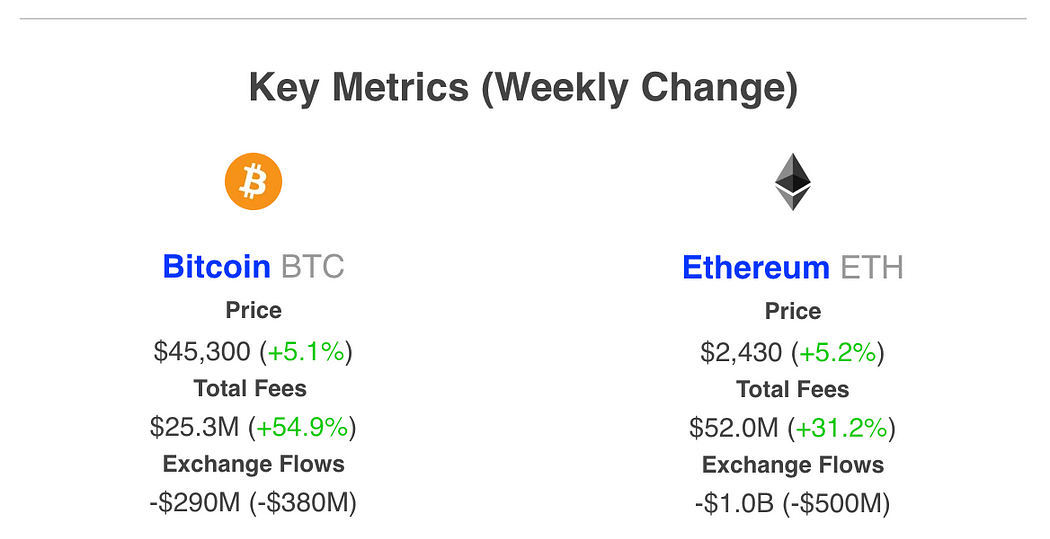

Ethereum (ETH) experienced a significant outflow from centralized exchanges this week, potentially easing selling pressure on the market. IntoTheBlock, a crypto analytics firm, reported that Ethereum’s netflows, which measure the movement of ETH in and out of exchanges, showed a net outflow of over $1 billion.

Lucas Outumuro, IntoTheBlock’s head of research, noted this outflow. He also observed a 30% increase in ETH’s network fees, indicating a willingness to spend and demand for the asset.

Bitcoin Also Flows Out

Bitcoin (BTC) followed a similar trend, with $300 million worth of net outflows, breaking an eight-week pattern of inflows. Additionally, Bitcoin’s network fees surged by more than 50%.

Correlation Between Exchange Inflows and Price Drops

A 2021 study by Santiment, another crypto analytics firm, suggested that large increases in exchange inflows often precede an average price drop of 5% for crypto assets.

Current Market Prices

At the time of writing, ETH is trading at $2,512, up 2.64% in the past 24 hours. BTC is trading at $47,478, showing a nearly 3% increase in the same period.

Disclaimer

Opinions expressed in this article are not investment advice. Investors should conduct thorough research before making high-risk investments in Bitcoin, cryptocurrency, or digital assets. Transfers and trades are at the individual’s own risk, and any losses incurred are their sole responsibility.