ETF Buyers Buck Sell-Off Trend

According to Bloomberg ETF expert Eric Balchunas, ETF investors are the “strong hands” currently buying up Bitcoin (BTC) during the recent sell-off.

Despite outflows from Grayscale’s ETF, Balchunas notes that these are primarily from a single entity, Genesis, converting ETF shares into spot Bitcoin.

ETF Investors Driving Inflows

Overall, ETF investors are not contributing to the sell pressure and are instead buying the dip. The nine new Bitcoin ETFs have attracted $1.2 billion in the past five days, even as prices declined by 8%.

“Boomer” Investors Show Resilience

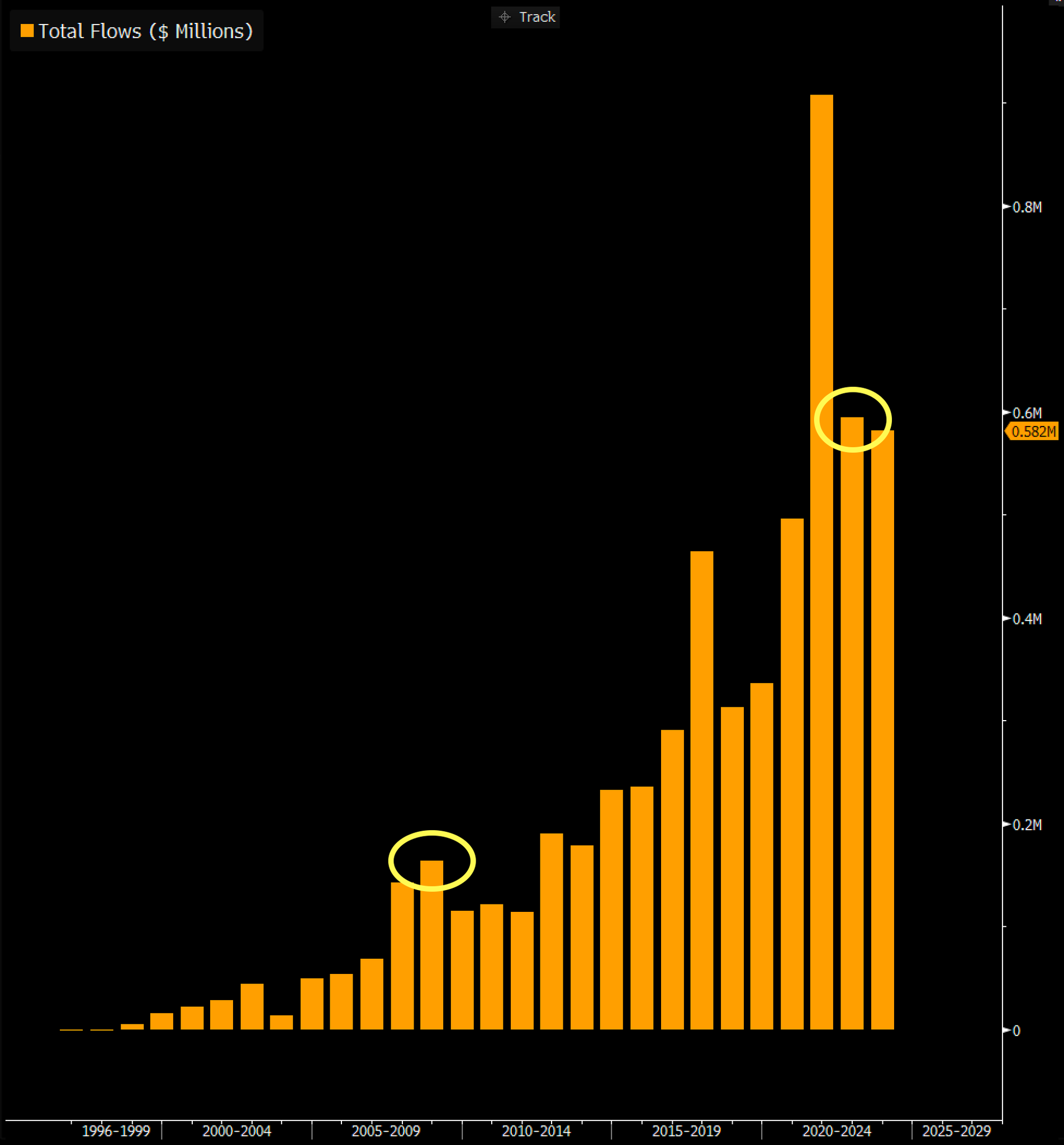

Balchunas highlights the historical resilience of “boomer” ETF investors, who have consistently held assets with conviction and invested heavily during market downturns. In 2008 and 2021, they poured billions of dollars into stock market index ETFs when equities were plummeting.

Long-Term Optimism

Balchunas believes that while there may be some outflows from ETFs, they will likely be minimal and outweighed by net inflows over time. He emphasizes that these investors are tougher than many believe and remain optimistic about Bitcoin’s long-term prospects.