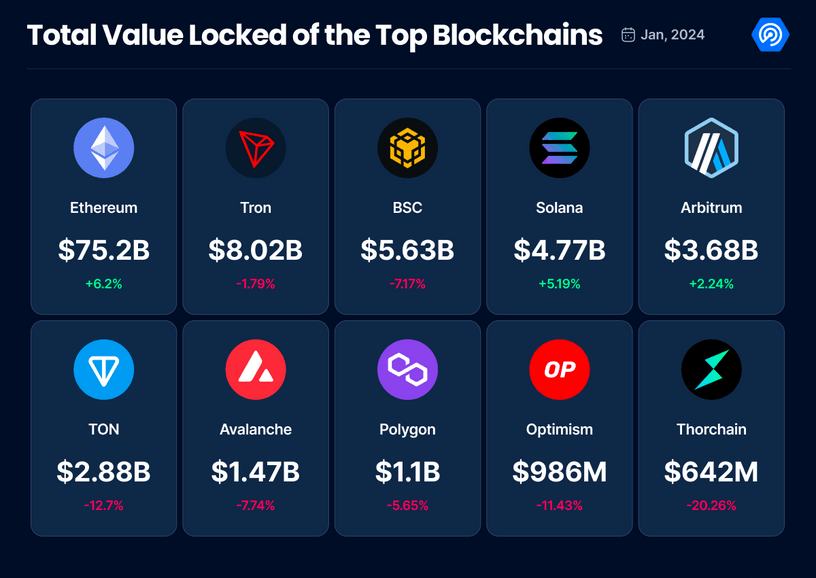

Total Value Locked (TVL) Increases by 7%

Crypto intelligence platform DappRadar reported a 7% increase in the total value locked (TVL) in the decentralized finance (DeFi) sector in January, reaching $110 billion. This marks the highest TVL since 2022. TVL represents the amount of capital deposited within a protocol’s smart contracts and is often used to assess the health of a crypto ecosystem.

Resurgence in the Market

DappRadar attributes the surge in TVL to growing optimism about a new bull market, leading to an uptick in overall token prices. Additionally, the launch of new chains offering airdrops has fueled airdrop hunting in the X ecosystem, contributing to the heightened activity in DeFi.

Ethereum, Solana, and Arbitrum See TVL Growth

Among the top ten chains, only three experienced TVL increases in January: Ethereum (ETH), Solana (SOL), and Arbitrum (ARB). Ethereum’s TVL jumped by 6.2%, Solana’s rose by 5.19%, and Arbitrum’s increased by 2.24%.

THORChain Suffers Largest TVL Slump

THORChain (RUNE) witnessed the largest TVL slump among the top 10 chains, decreasing by more than 20%.

Conclusion

The DeFi sector’s overall increase in TVL indicates a resurgence in the market. Growing optimism about a new bull market, the launch of new chains offering airdrops, and the growth of Ethereum, Solana, and Arbitrum have contributed to this surge. However, THORChain’s significant TVL slump highlights the volatility of the DeFi sector.