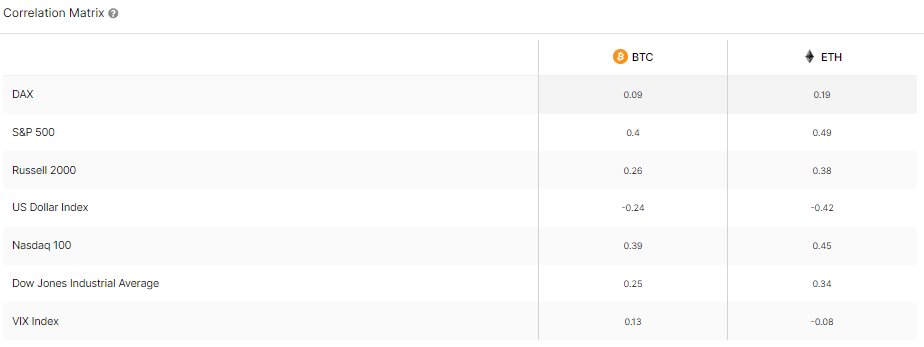

Correlation with Traditional Markets

Data from IntoTheBlock shows that Bitcoin (BTC) and Ethereum (ETH) have recently shown little correlation with traditional markets and commodities. This means that the crypto market is charting its own course.

Correlation Coefficients

The correlation coefficient (r) measures the connection between two quantities. A value above zero indicates a positive correlation, meaning the assets move in tandem. A value below zero indicates a negative correlation, meaning the assets move in opposite directions. A value near zero suggests no relationship.

Bitcoin and Ethereum’s Correlation

Over the past 30 days, BTC and ETH have had low correlations with traditional assets:

| Asset | BTC Correlation | ETH Correlation |

|---|---|---|

| S&P 500 | 0.4 | 0.49 |

| Gold | 0.02 | 0.07 |

| Crude Oil | 0.03 | 0.08 |

Implications for Investors

The low correlation suggests that cryptocurrencies have been operating independently of traditional markets. This makes BTC and ETH potential diversification options for investors seeking to reduce risk in their portfolios.

Bitcoin Price Update

BTC has recently fallen back to around $61,100 after a brief recovery.