Open Interest: A Measure of Market Activity

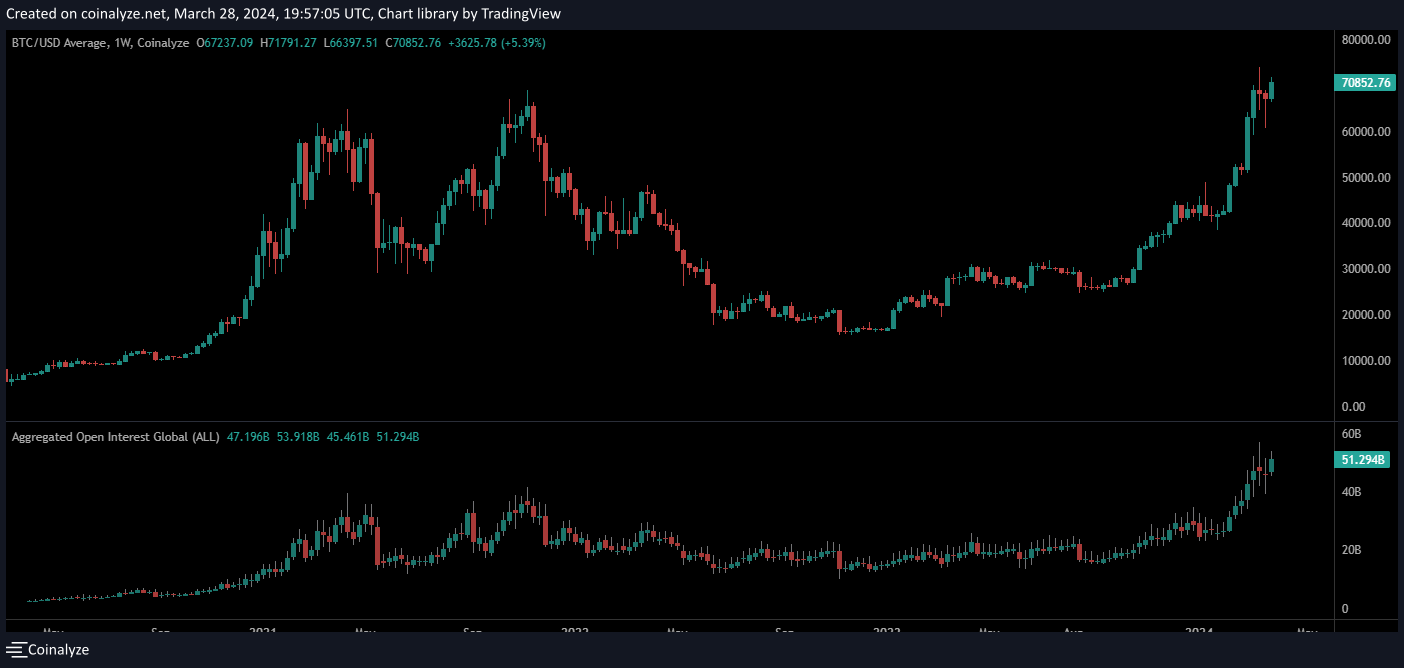

The total open interest in the crypto market, which measures the number of active derivative positions, has reached an all-time high of $51.3 billion. This indicates that investors are actively placing bets on the future direction of cryptocurrencies.

Volatility Ahead?

Typically, high open interest levels suggest increased leverage in the market, which can lead to increased volatility. When investors open new positions, they essentially borrow funds to amplify their potential profits. This can lead to sharp price swings, both upwards and downwards.

Historical Trends

In the past, periods of high open interest have often coincided with significant market movements. During the 2021 bull run, open interest surged before the market peaked. However, the current levels have surpassed even those seen at that time.

Bitcoin Price Impact

Historically, sharp declines in open interest have often accompanied major Bitcoin price crashes. This suggests that the current high open interest levels could be a warning sign for the crypto market.

Current Bitcoin Price

At the time of writing, Bitcoin is trading around $70,100, up 9% over the past week.