Bitcoin has recently made a remarkable recovery, surpassing the $44,500 mark. This surge in value has sparked curiosity among investors and analysts, leading to speculation about the underlying factors contributing to this upward trend.

Factors Behind the Bitcoin Price Surge

1. Accumulation by Bitcoin Whales:

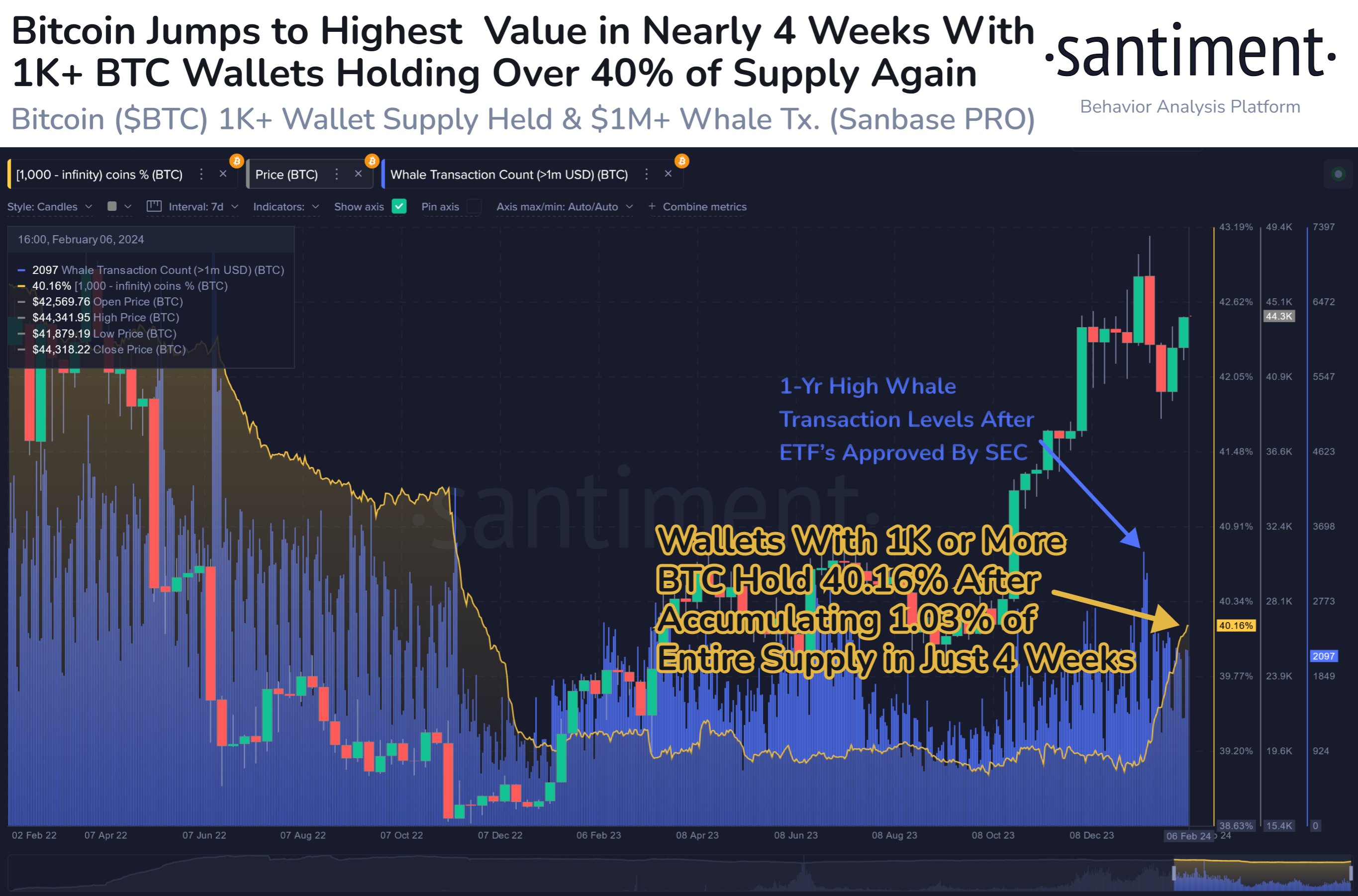

On-chain data from Santiment reveals a significant increase in the holdings of Bitcoin whales, entities holding at least 1,000 BTC. This group has been steadily accumulating Bitcoin over the past few weeks, adding 1% of the entire supply to their wallets in just four weeks.

2. Whales’ Influence on the Market:

Due to their substantial holdings, Bitcoin whales can influence market movements. Their accumulation suggests confidence in Bitcoin’s long-term potential and may have contributed to the recent price surge.

3. Post-ETF Approval Consolidation:

After the launch of spot exchange-traded funds (ETFs), Bitcoin experienced a period of consolidation and price fluctuations. However, it appears that whales took advantage of this dip to acquire more Bitcoin at lower prices.

Whales’ Role in Bitcoin’s Recovery:

The accumulation by Bitcoin whales is seen as a positive sign, indicating their belief in the cryptocurrency’s future. This accumulation may have provided the impetus for the recent recovery, although it remains to be seen if they will continue to support Bitcoin or sell to lock in profits.

Conclusion:

The recent surge in Bitcoin’s price can be attributed to several factors, including the accumulation by Bitcoin whales, their influence on the market, and the post-ETF approval consolidation. As Bitcoin continues to navigate market dynamics, it will be interesting to observe whether whales will maintain their support or if the market will experience a correction.