Bitcoin’s Rise

Bitcoin has been on a tear, breaking above $51,500 after a brief dip below $49,000. This surge has pushed the cryptocurrency to its highest point since December 2021.

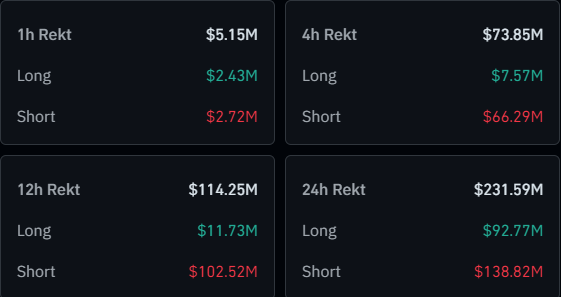

Futures Market Bloodbath

The futures side of the crypto market has witnessed a bloodbath, with $221 million in liquidations over the past 24 hours. Short holders took the brunt of the pain, accounting for over 60% of the liquidations.

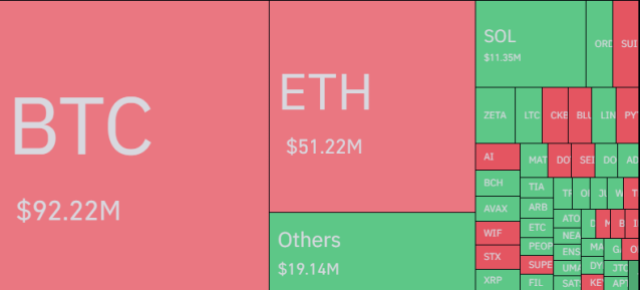

Short Squeeze

The liquidations have been dubbed a “short squeeze,” where a surge in price forces short sellers to close their positions, leading to a cascading effect of further liquidations. Bitcoin’s liquidations totaled $92 million, while Ethereum contributed $51 million.

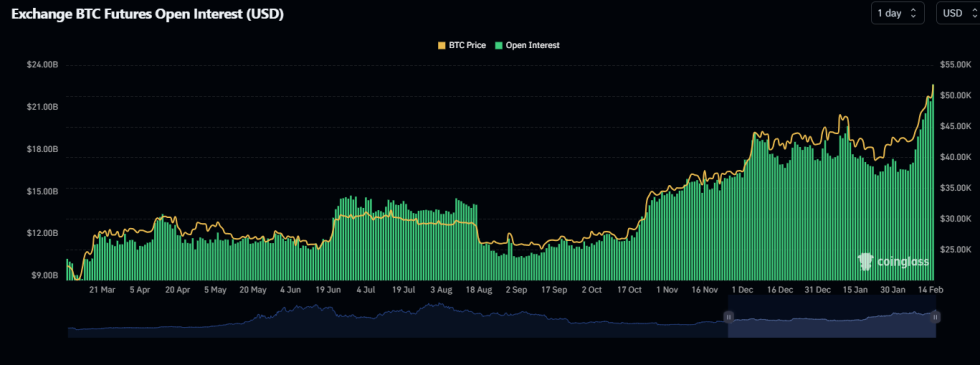

Open Interest on the Rise

Despite the liquidations, speculators remain bullish, as the Bitcoin Open Interest continues to climb. This indicates that traders are still betting on the cryptocurrency’s continued rise.