Experts Weigh In

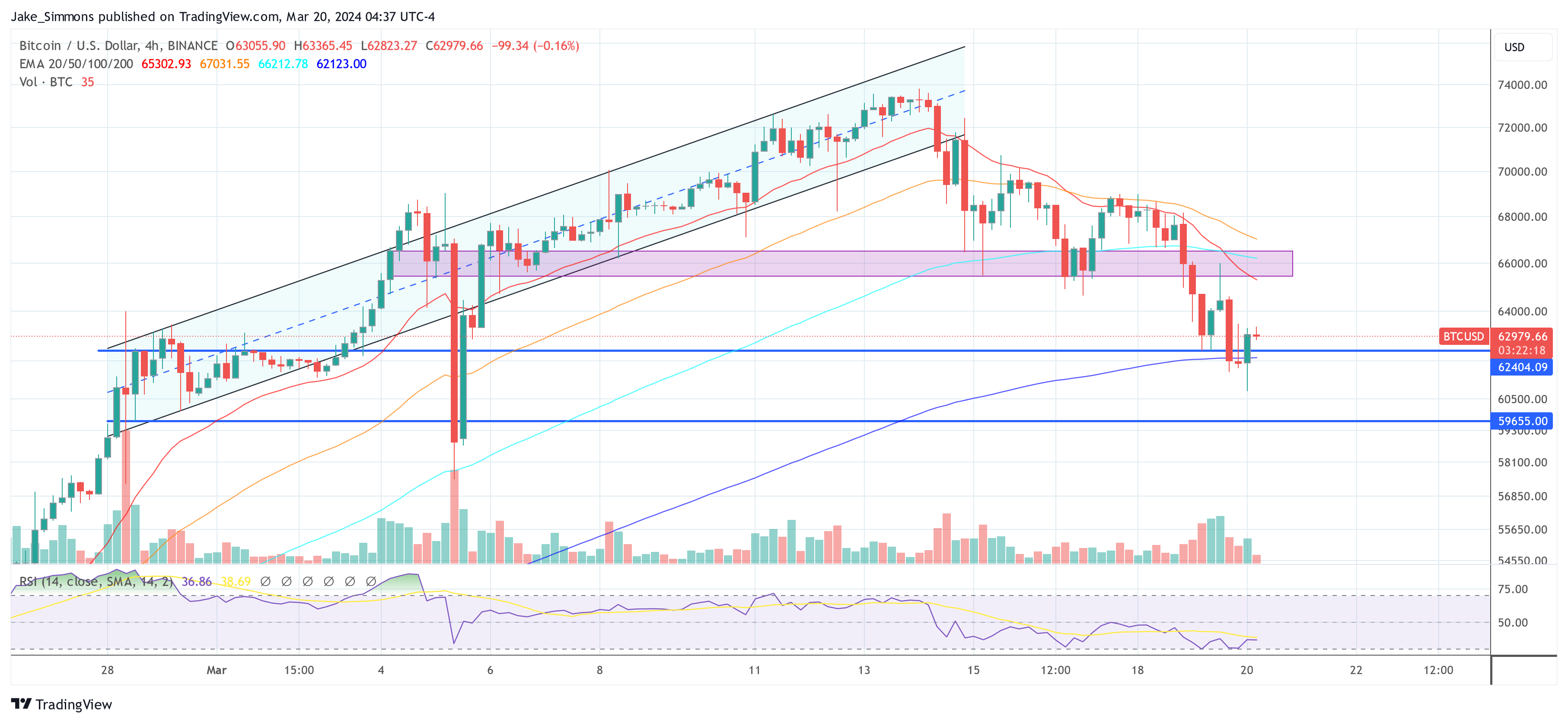

Bitcoin has taken a hit, dropping from over $73,600 in March to around $60,800 today. This has sent shockwaves through the crypto community.

Causes of the Crash

Experts have identified several reasons for the decline:

- Excessive leverage: Traders were borrowing too much money to invest in Bitcoin.

- Ethereum’s influence: Ethereum’s price drop hurt overall market sentiment.

- ETF outflows: Investors were pulling money out of Bitcoin ETFs.

- Solana “memecoin mania”: Speculation in Solana’s “shitcoins” created irrational exuberance.

Expert Opinions

- Alex Krüger:

The crash is due to excessive leverage, Ethereum’s impact, and ETF outflows.

- WhalePanda: ETF outflows, particularly from GBTC, have been alarming.

- Charles Edwards: A 20-30% pullback is normal for Bitcoin bull runs.

- Rekt Capital:

The current pullback is only the fifth major one since the 2022 bear market bottom.

- Alex Thorn: Corrections are common in Bitcoin bull markets.

- Ted: The FOMC meeting and tax season may have contributed to the decline. However, the market may have priced in the worst-case scenario.

Is the Worst Over?

It’s hard to say for sure. Some experts believe the worst may be behind us, while others caution that the market is still volatile. The FOMC meeting and tax season could still impact Bitcoin’s price.

Key Takeaways

- The Bitcoin crash was caused by multiple factors.

- Experts have varying opinions on the future of Bitcoin’s price.

- The market may have priced in the worst-case scenario, but volatility is still possible.