Funding Rate Dip: A Brief Bearish Blip

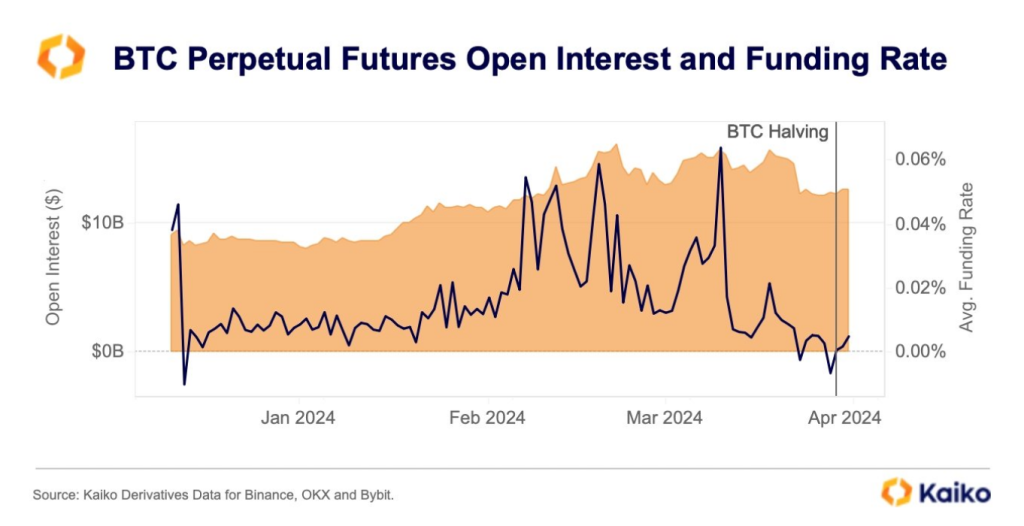

After the recent Bitcoin halving, the funding rate briefly dipped into negative territory, indicating a bearish outlook. However, this dip was short-lived.

Renewed Bullishness

Following the halving, the funding rate quickly recovered and is now positive, suggesting a return to a bullish market sentiment.

Increased Open Interest

The total amount of outstanding futures contracts (Open Interest) has rebounded to over $17 billion, indicating continued investor engagement.

Halving Impact Exceeds Historical Trends

Bitcoin’s price increase since the halving has exceeded that of previous halvings, suggesting a more positive impact.

Macroeconomic Factors Fueling Bullishness

Global inflation and geopolitical uncertainties are driving investors towards assets like Bitcoin, which is seen as a hedge against inflation.

Institutional Adoption

Increasing institutional adoption of Bitcoin is seen as a positive sign for its long-term prospects.

Cautionary Note

Analysts caution against drawing definitive conclusions from short-term fluctuations. The true impact of the halving on Bitcoin’s price may not be fully evident for several months.