All-Time High

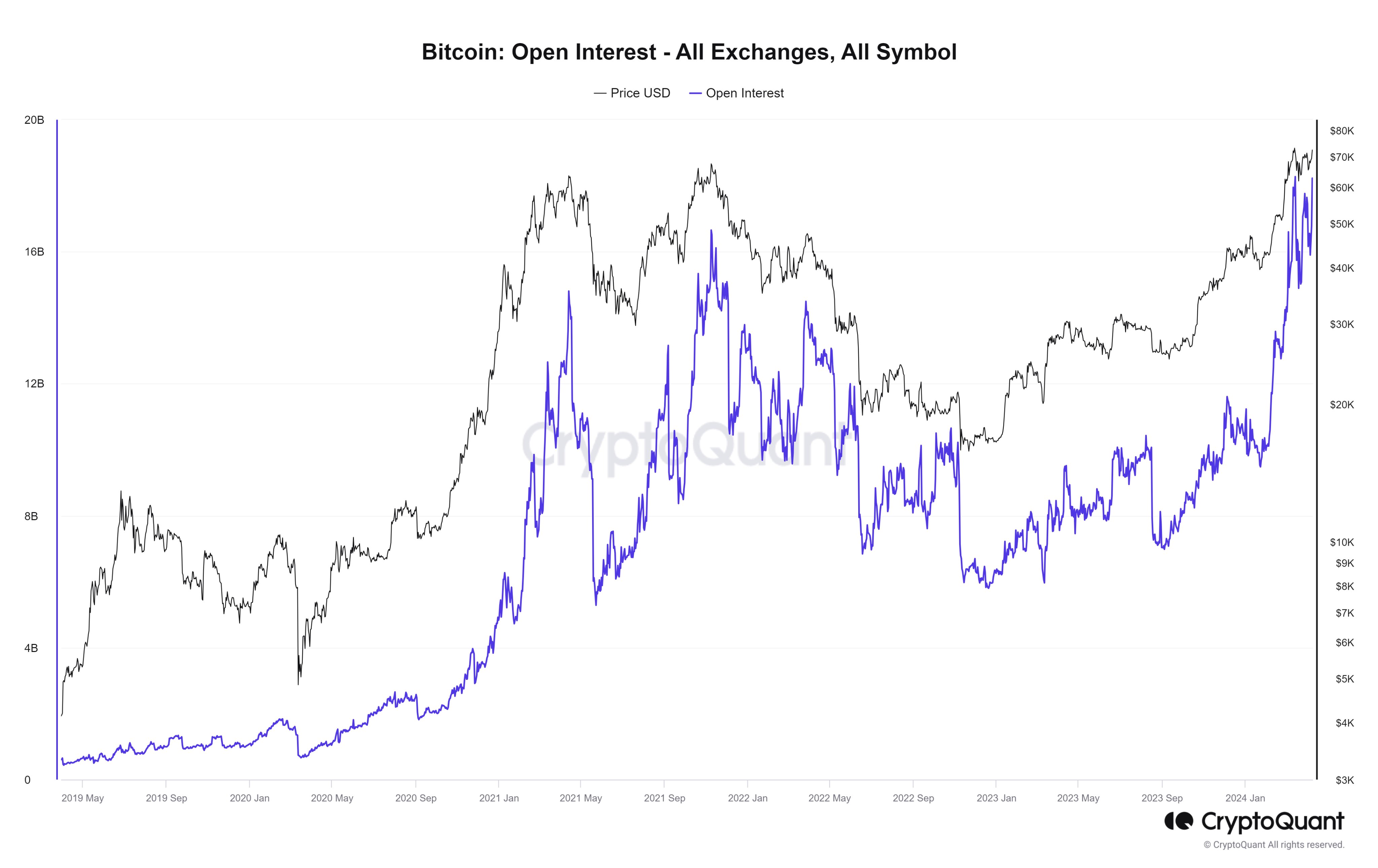

Bitcoin’s Open Interest, which measures the total amount of derivative contracts, has hit a new record high of $18.2 billion. This surge coincides with Bitcoin’s price crossing $72,000.

Speculation and Volatility

Increased Open Interest often attracts more speculation and leverage in the market, which can lead to higher volatility. Historically, previous Open Interest highs have been followed by price corrections.

Liquidations and Squeezes

Extreme Open Interest levels can trigger liquidations, where traders are forced to close their positions. These liquidations can further fuel price swings, creating a “squeeze” where the price moves rapidly in one direction.

Recent Price Action

The latest price rally has also resulted in significant liquidations, with shorts in the cryptocurrency sector losing $108 million. As of writing, Bitcoin is trading around $71,500, up 5% over the past week.

Potential Implications

The high Open Interest levels could indicate increased volatility for Bitcoin in the near future. However, it’s uncertain whether the price will follow the same pattern as previous Open Interest highs.