Economist Alex Krüger believes traditional finance (TradFi) companies have three choices when it comes to Bitcoin:

-

Buy Bitcoin now: Krüger advises that TradFi portfolio managers should invest in Bitcoin to avoid underperforming for the next decade.

-

Buy Bitcoin later: This option may result in underperformance compared to those who invest sooner.

-

Underperform for the next decade: This is the likely outcome for TradFi managers who choose not to invest in Bitcoin.

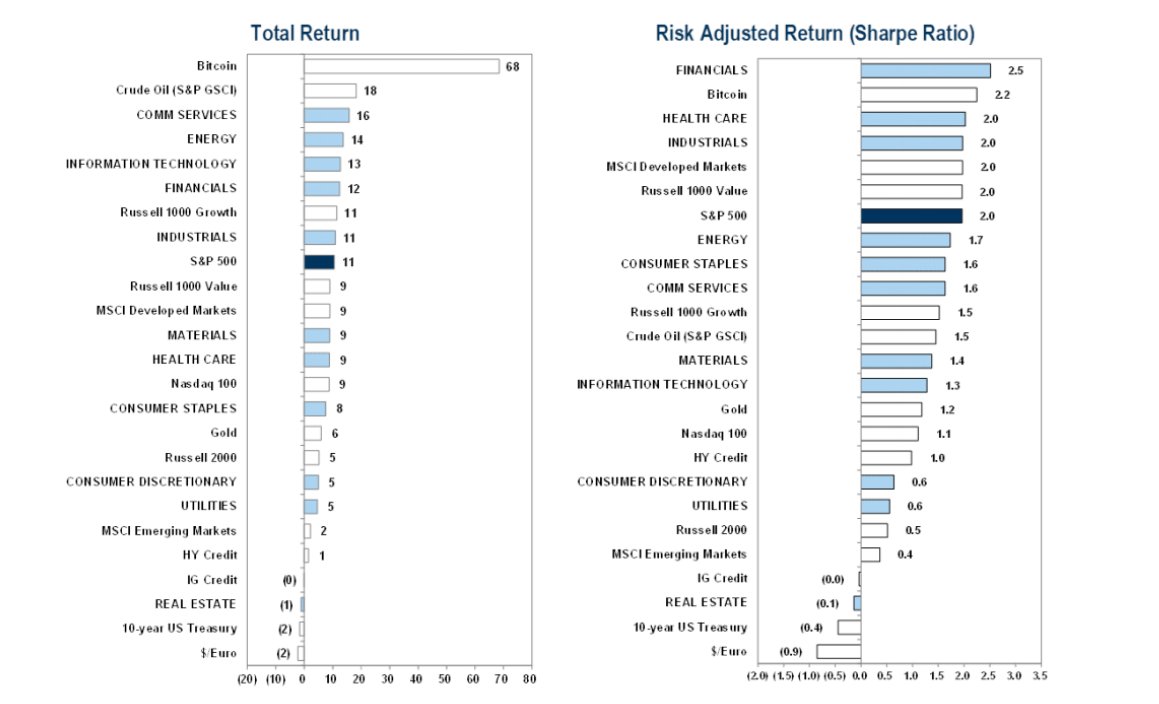

Krüger supports his argument with data from Goldman Sachs showing Bitcoin’s superior performance over other financial assets. He also highlights the recent price correction as an opportunity to buy before the next Bitcoin halving, when miners’ rewards are reduced.

Why Bitcoin Is a Smart Investment

Despite the recent price volatility, Krüger believes Bitcoin is a wise investment. He cites the massive inflows into Bitcoin exchange-traded funds (ETFs) as evidence of its growing popularity. He also emphasizes that the most significant profits are often made during periods of extreme market volatility.

Conclusion

Krüger’s analysis suggests that TradFi companies need to consider investing in Bitcoin to remain competitive in the future. By ignoring Bitcoin, they risk falling behind and underperforming in the years to come.