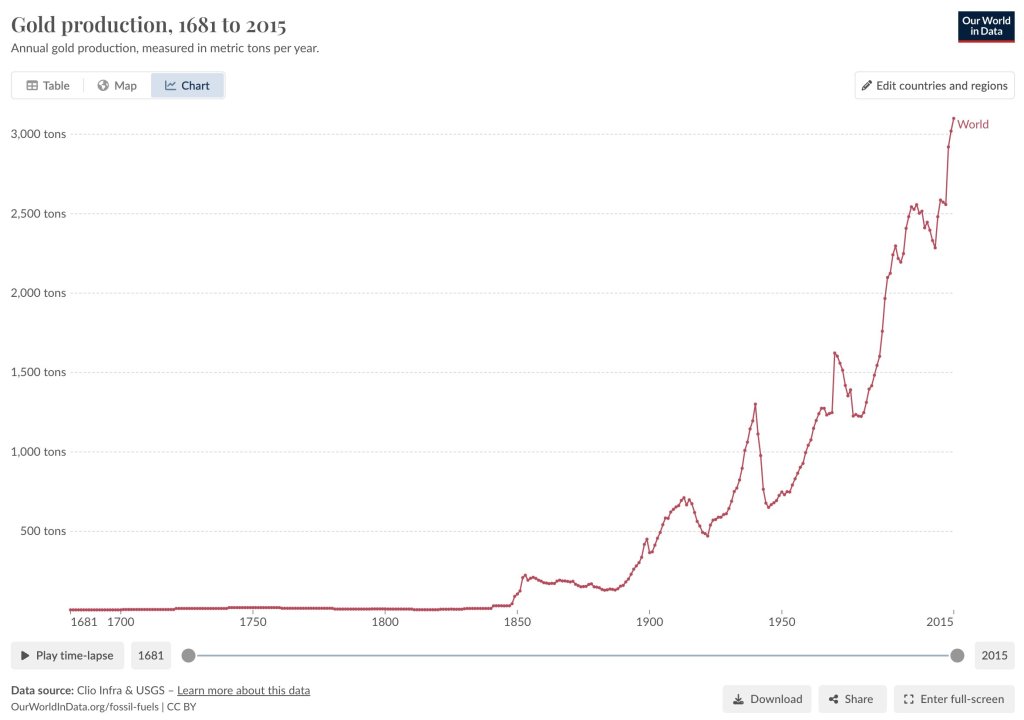

Scarcity vs. Oversupply

Analyst Willy Woo believes the tide is turning in the battle between gold and Bitcoin. While gold has long been considered a scarce asset, advancements in mining have eroded its scarcity. Meanwhile, Bitcoin’s supply is decreasing due to the Halving events.

Bitcoin’s Scarcity Advantage

Bitcoin’s Halving events have reduced the daily issuance of new coins to miners. This makes Bitcoin increasingly scarce, while gold faces the risk of oversupply in the coming years.

Gold: A “Slow-Moving Rug Pull”?

Woo believes that gold holders will face challenges as new supply floods the market. He calls gold a “slow-moving rug pull” that will play out over the next decade.

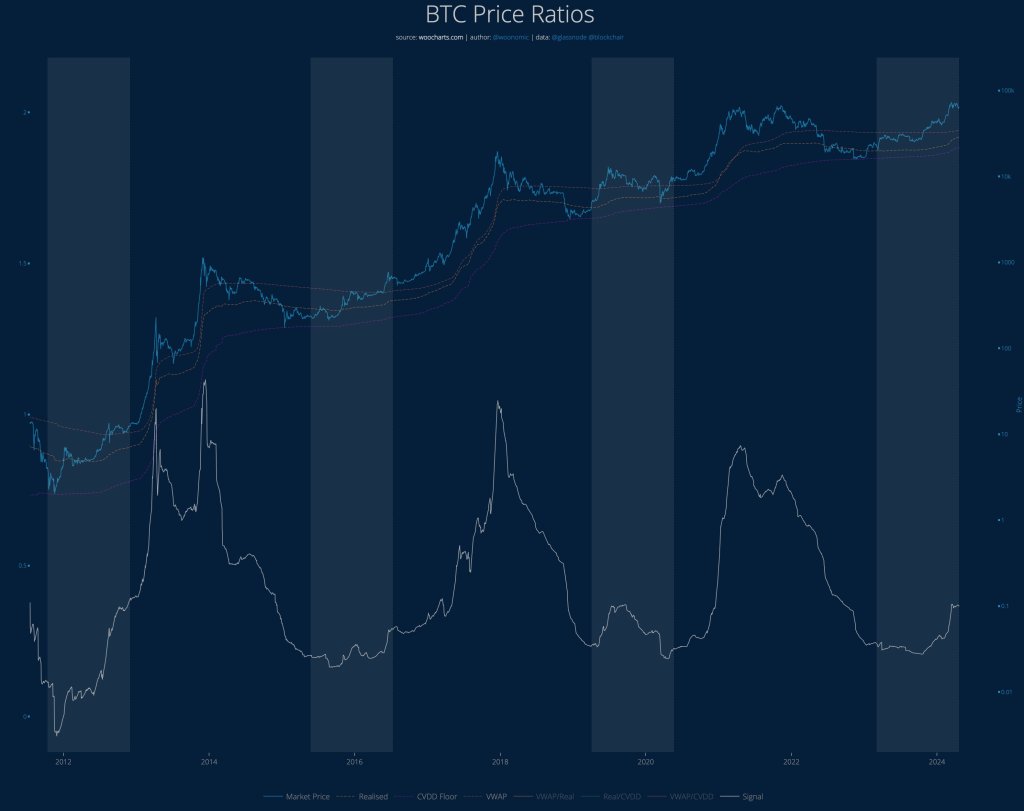

Bitcoin’s Rally Potential

Woo also suggests that Bitcoin is gearing up for a major rally. Despite reaching a high of $73,800 in 2024, the rally has not yet begun. Woo predicts that Bitcoin will set a new all-time high, driven by market demand and dominance.