Funding Rate and Basis Point to a Price Surge

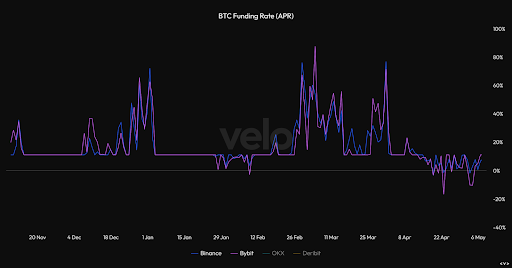

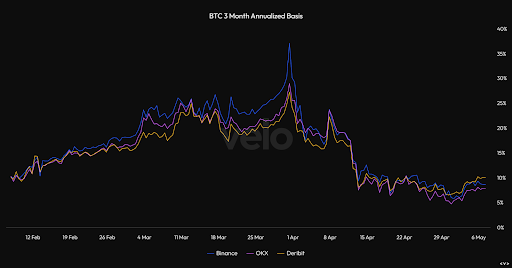

Crypto analyst Will Clemente observes that Bitcoin’s funding rate and 3-month annualized basis are cooling off after recent negative readings. This suggests a dominance of long-position trades, indicating growing investor confidence in Bitcoin’s future price action.

Positive Funding Rate and Price Increase

The funding rate has rebounded from negative territory to 0.0090%, coinciding with Bitcoin’s price increase to $64,000. A positive funding rate indicates that traders are willing to pay more to maintain long positions, which could drive the price higher.

3-Month Annualized Rate Signals Bullishness

The 3-month annualized rate is also rising, suggesting that investors are buying spot Bitcoin while simultaneously selling futures contracts expiring in three months. This bullish signal typically attracts more investors.

Stablecoin Supply and Whale Accumulation

The total supply of stablecoins is increasing, indicating that investors are preparing to invest in Bitcoin. Additionally, wallets holding 100 to 1,000 BTC have been accumulating more Bitcoin in the past two months, suggesting a strong belief in its future value.

Conclusion

With key indicators cooling off and positive signals emerging, Bitcoin appears poised for a rally. The funding rate, 3-month annualized rate, stablecoin supply, and whale accumulation all point to a potential price surge in the coming weeks.