Skip to content

- Home

- Bitcoin

- Bitcoin Price Rally to $58,000: Expert Analysis

Market Analysis

- Recent market behavior shows a shift in momentum after the Bitcoin ETF launches.

- Outflows from Grayscale Bitcoin ETF have decreased, aligning with predictions.

- Blackrock and Fidelity’s Bitcoin ETFs (IBIT and FBTC) have absorbed over $6 billion in assets, signaling broader acceptance.

- Bitcoin’s ETF launch is the most successful in history, underscoring its mainstream adoption.

- Fidelity’s inclusion of Bitcoin in its All-in-One Conservative ETF is a significant endorsement.

- Major ETFs are likely to allocate 1-5% to Bitcoin in the next 12-24 months, boosting its mainstream acceptance.

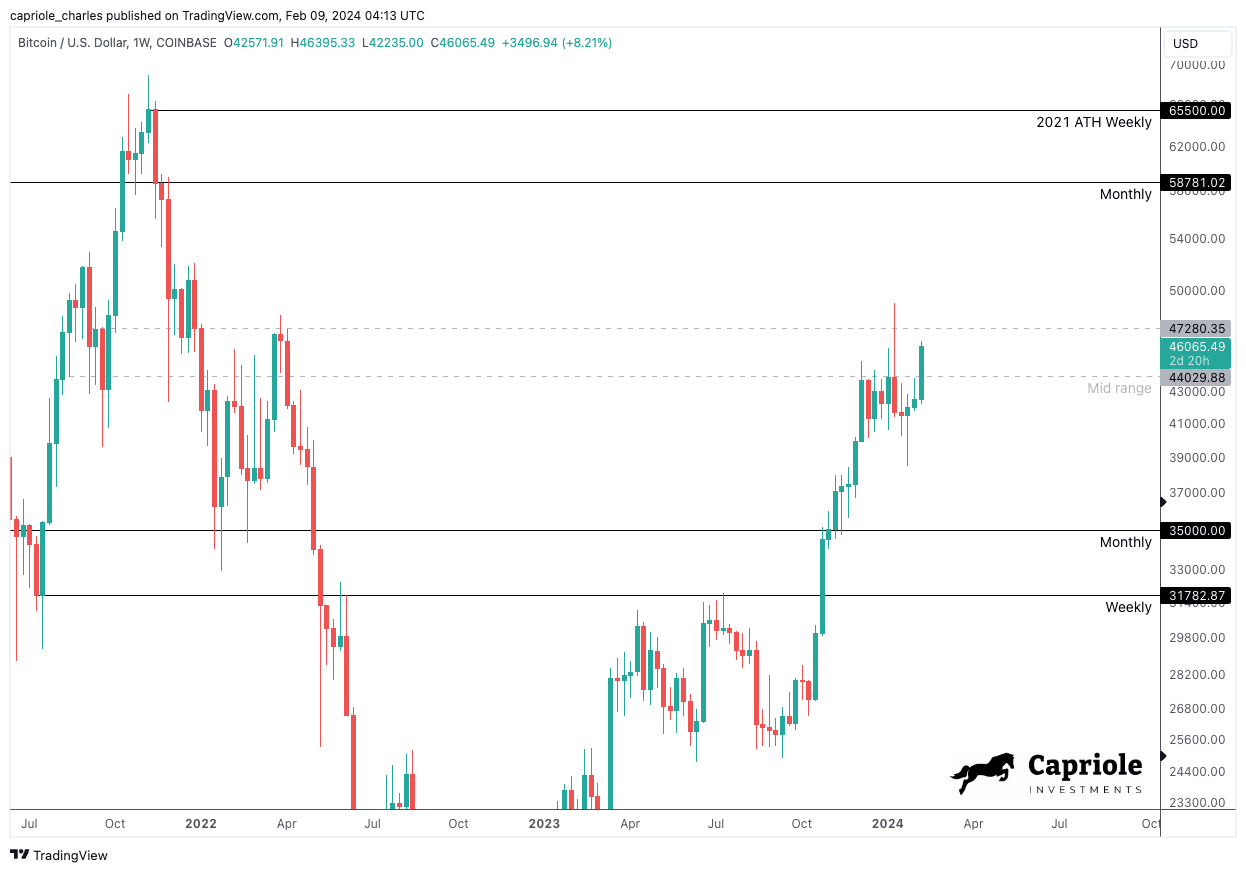

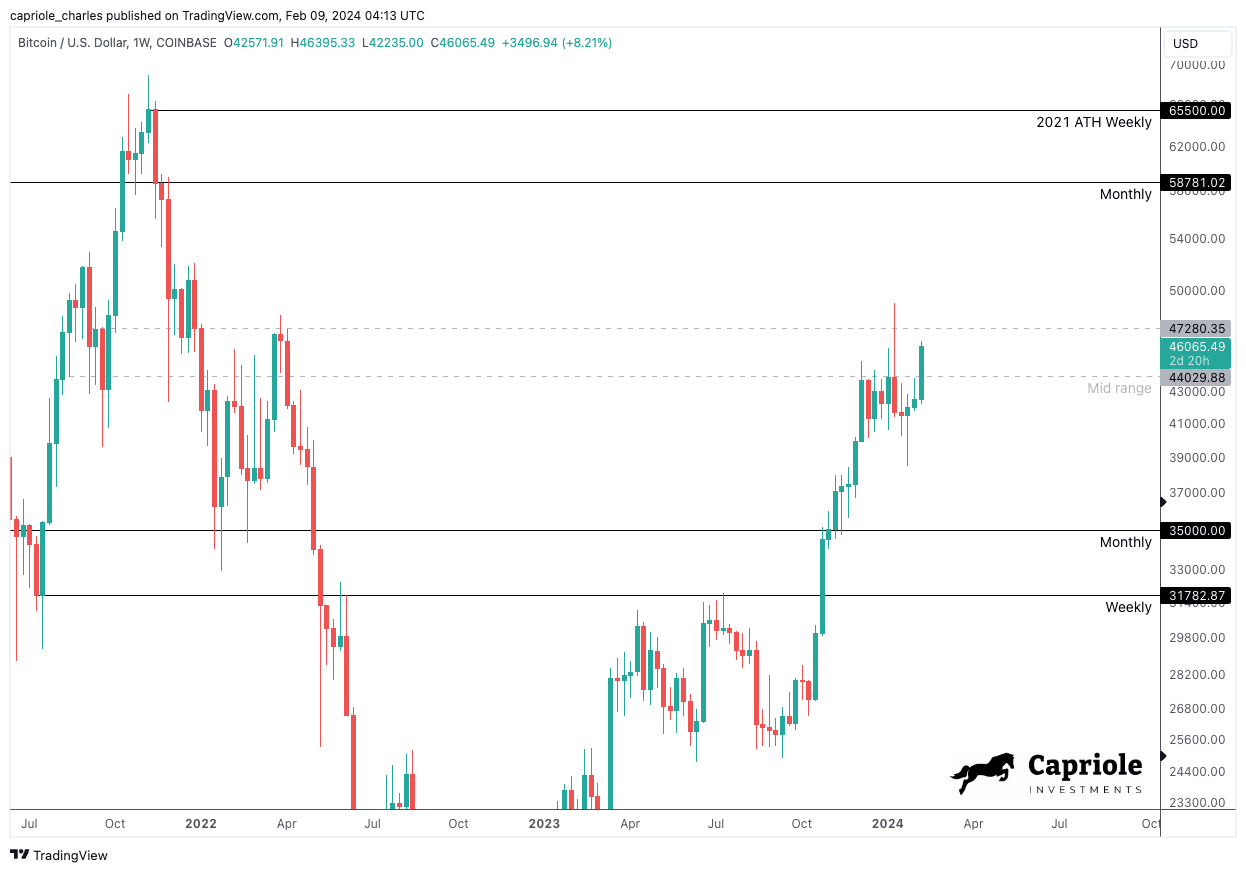

Technical Outlook and Price Prediction

- Bitcoin broke past the $44,000 resistance level, indicating a bullish trend.

- A weekly closing above $47K would confirm the new bullish trend.

- Low timeframe technicals suggest a measured move towards monthly resistance, presenting a favorable risk-to-reward setup.

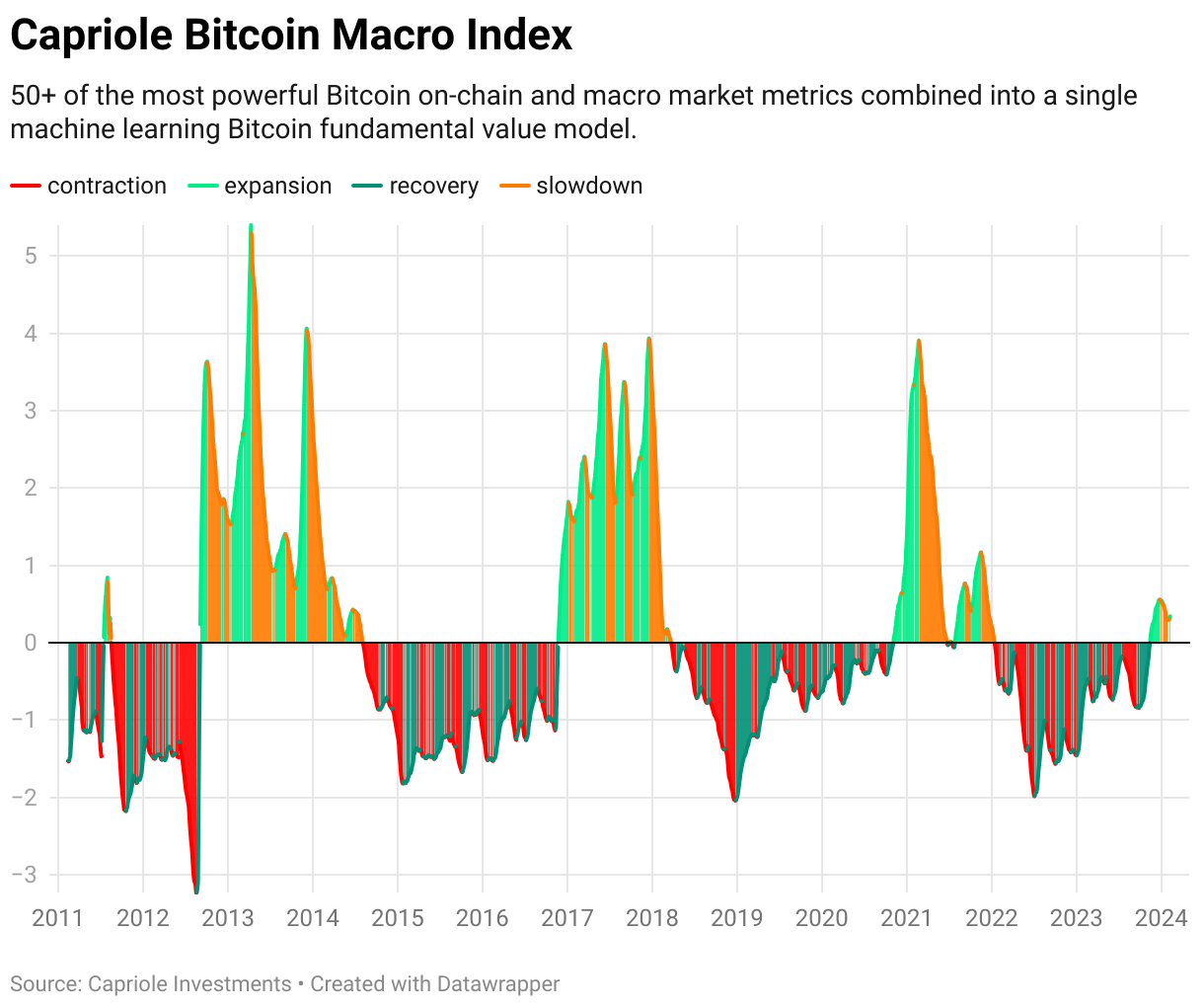

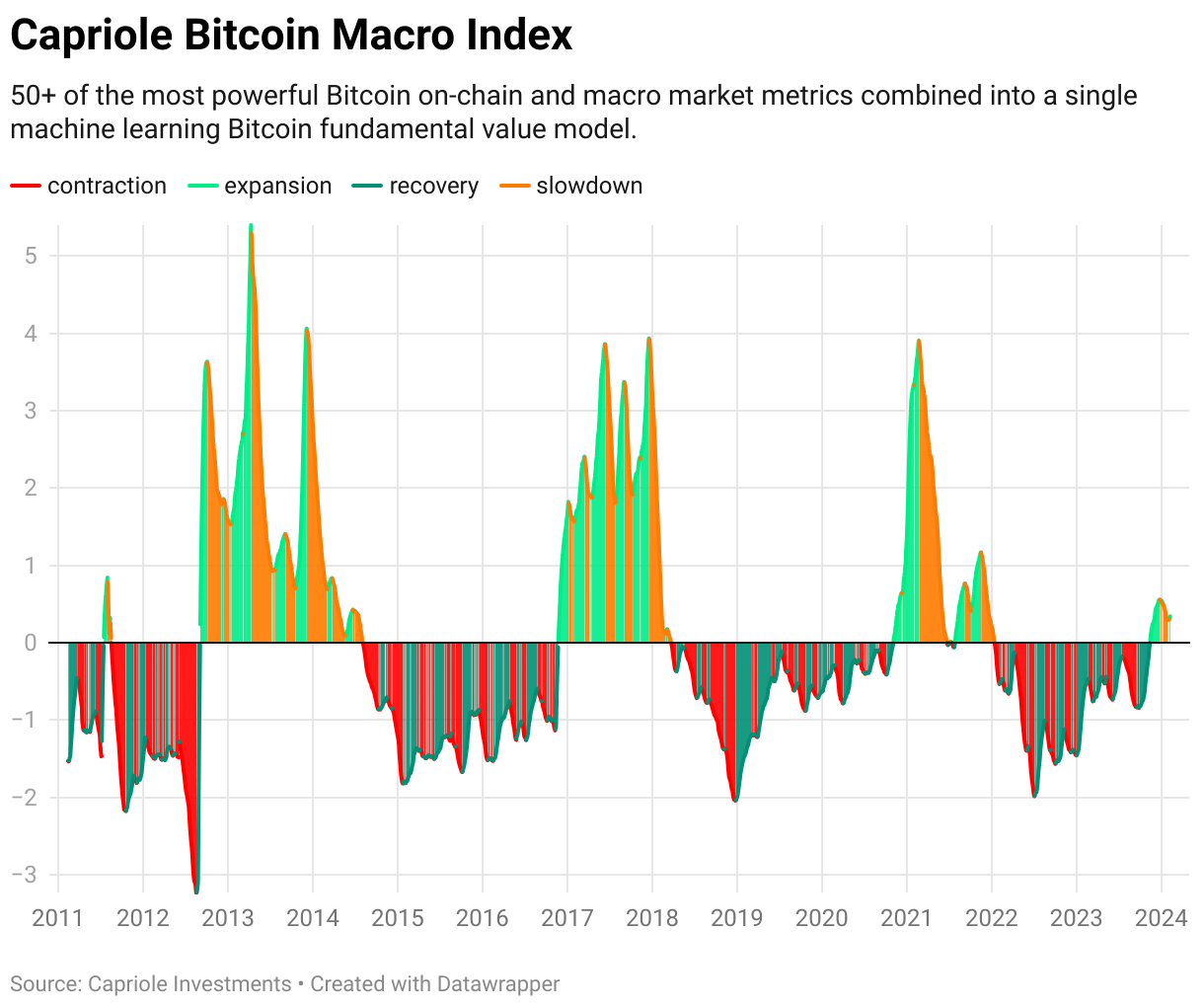

Fundamental Indicators

- Capriole’s Bitcoin Macro Index, aggregating over 50 Bitcoin-related metrics, shows a fundamental uptrend.

- On-chain fundamentals are transitioning into growth territory, supporting the technical breakout.

Conclusion

- ETF concerns have been cleared, and technical and fundamental indicators are bullish.

- Bitcoin’s short-term future looks optimistic, with a strong start to February.