The cryptocurrency market is buzzing with anticipation as the possibility of spot Bitcoin ETFs (exchange-traded funds) approval in early 2024 looms on the horizon. While this development might appear to be a bullish omen for Bitcoin, experts are painting a more nuanced picture.

Bitcoin ETFs and the “Sell-the-News” Phenomenon

CryptoQuant, a well-known analytics firm, has observed a 90% likelihood of spot Bitcoin ETF approvals by early January. This optimism, backed by 32 meetings between ETF issuers and the US Securities and Exchange Commission (SEC), suggests a positive dialogue. However, it also sets the stage for a classic “sell-the-news” event.

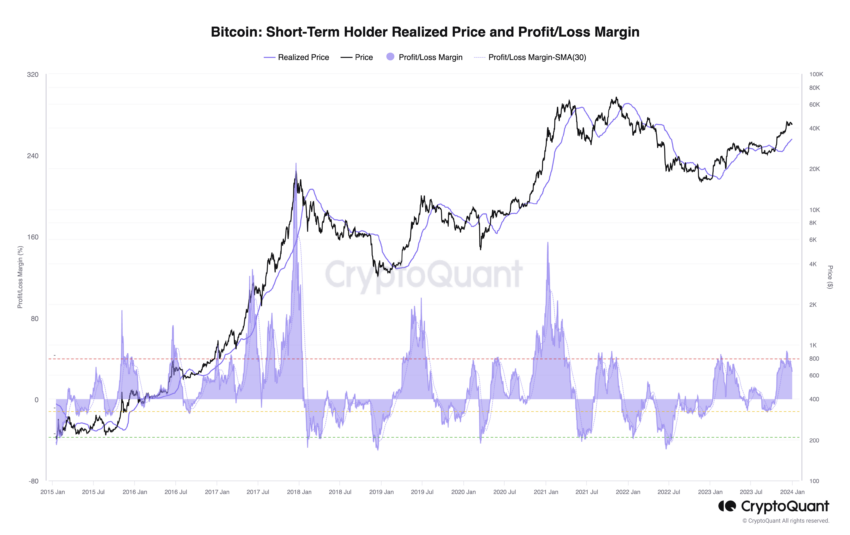

Analysts at CryptoQuant argue that there is a growing chance that the ETF approval could trigger profit-taking. Short-term Bitcoin holders are currently sitting on significant unrealized profits, with margins as high as 30%. Historically, such situations have often been followed by price corrections.

Furthermore, the recent news of Blackrock seeding its ETF with $10 million is viewed as a positive sign. Nevertheless, CryptoQuant highlights the behavior of Bitcoin miners, who are currently experiencing substantial unrealized profits and have begun to increase their selling activities. This could exert downward pressure on Bitcoin’s price.

As a result, CryptoQuant predicts that Bitcoin’s price may decline, potentially reaching as low as $32,000, aligning with the realized price of short-term holders.

Cathie Wood and Nic Carter’s Perspectives

Cathie Wood, the CEO and CIO of ARK Invest, offers a nuanced viewpoint. She acknowledges the possibility of a short-term sell-off but remains optimistic about Bitcoin’s long-term prospects. Wood believes that even a modest institutional investment could have a significant impact on Bitcoin’s price. With trillions of dollars in assets potentially allocated to Bitcoin, a 0.1% move by institutions could “move the needle.” Wood’s optimism is grounded in Bitcoin’s scarcity and the expected influx of institutional funds after ETF approval.

Nic Carter, a funding partner at Castle Island Ventures, shares a similar sentiment. While he agrees with the idea of a short-term sell-off, he is hopeful about the medium-term effects. According to Carter, the ETF has the potential to unlock new capital classes, leading to structural flows that would benefit Bitcoin. He downplays the significance of the halving event in comparison to the ETF’s potential to attract new investments.

Historical Trends and January 2024

Ali Martinez, Global Head of News at BeInCrypto, offers a historical perspective on Bitcoin. He notes that strong BTC performances towards the end of the year have often been followed by bearish trends in January. This historical pattern suggests that January 2024 could witness a spike in profit-taking, aligning with the predictions of other analysts regarding a potential price drop.