Bitcoin’s price has taken a tumble, falling below $66,000. Here are four reasons why:

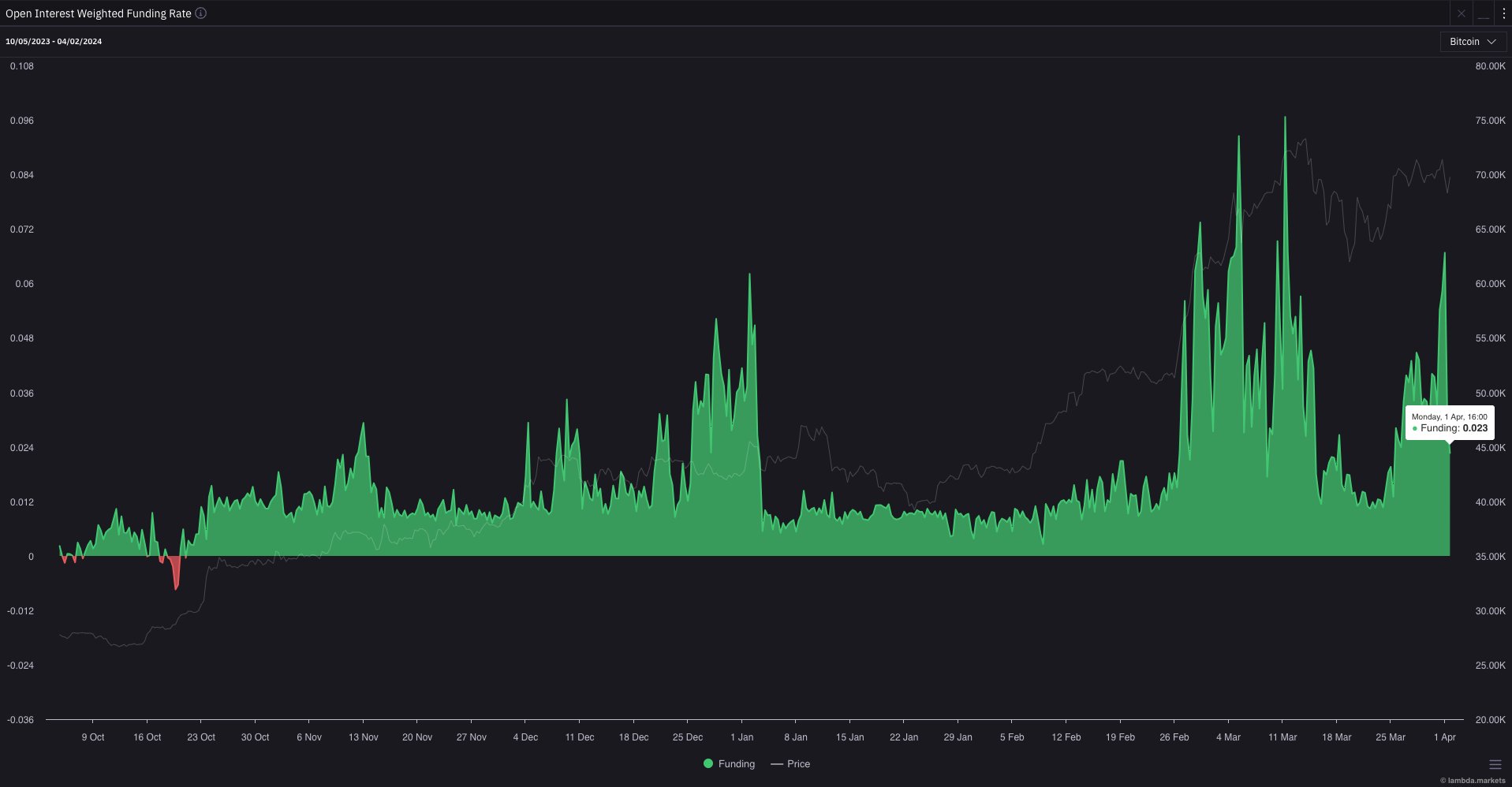

1. Liquidation Event

A lot of traders who had bet on Bitcoin going up (long positions) were forced to sell when the price dropped. This is called a liquidation event. It’s like a domino effect, where one sale triggers more sales, driving the price down further.

2. Rising US Dollar

The US dollar has been getting stronger, which makes Bitcoin less attractive to investors. When the dollar is strong, people tend to invest in safer assets like bonds or gold instead of riskier ones like Bitcoin.

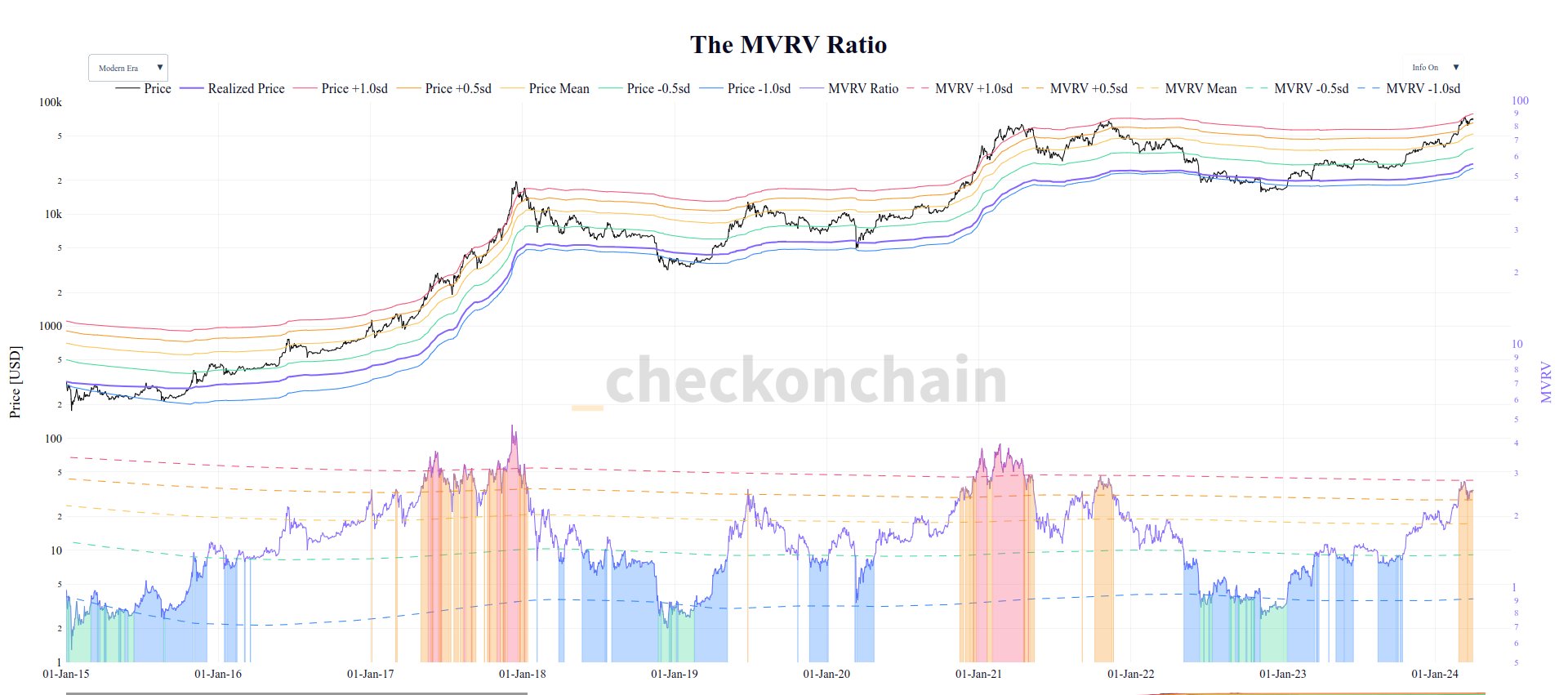

3. Profit-Taking

Some investors who had bought Bitcoin at a lower price decided to sell and take their profits. This happens when the price of an asset goes up a lot, and investors want to cash out their gains.

4. Bitcoin ETF Outflows

There has been a decrease in the amount of money flowing into Bitcoin ETFs, which are investment funds that track the price of Bitcoin. This suggests that investors are less interested in buying Bitcoin right now.

Conclusion

The recent drop in Bitcoin’s price is likely due to a combination of factors, including a liquidation event, a rising US dollar, profit-taking, and Bitcoin ETF outflows. It’s important to remember that cryptocurrency prices can be volatile, so it’s always a good idea to invest only what you can afford to lose.