Liquidations Triggered Price Drop

The Bitcoin market experienced a sharp decline due to a massive liquidation event in the futures market. Over $682 million worth of crypto trader liquidations occurred, with 80% being long positions. This caused Bitcoin’s price to plummet from $72,000 to $66,500 in a matter of hours.

Macroeconomic Pressures Weigh In

Macroeconomic factors have also contributed to Bitcoin’s price drop. Rising US bond yields and concerns about persistent inflation have led traders to adjust their expectations for the Federal Reserve’s interest rate policies. This has created uncertainty in the cryptocurrency market.

Coinbase Premium and Bitcoin ETF Dynamics

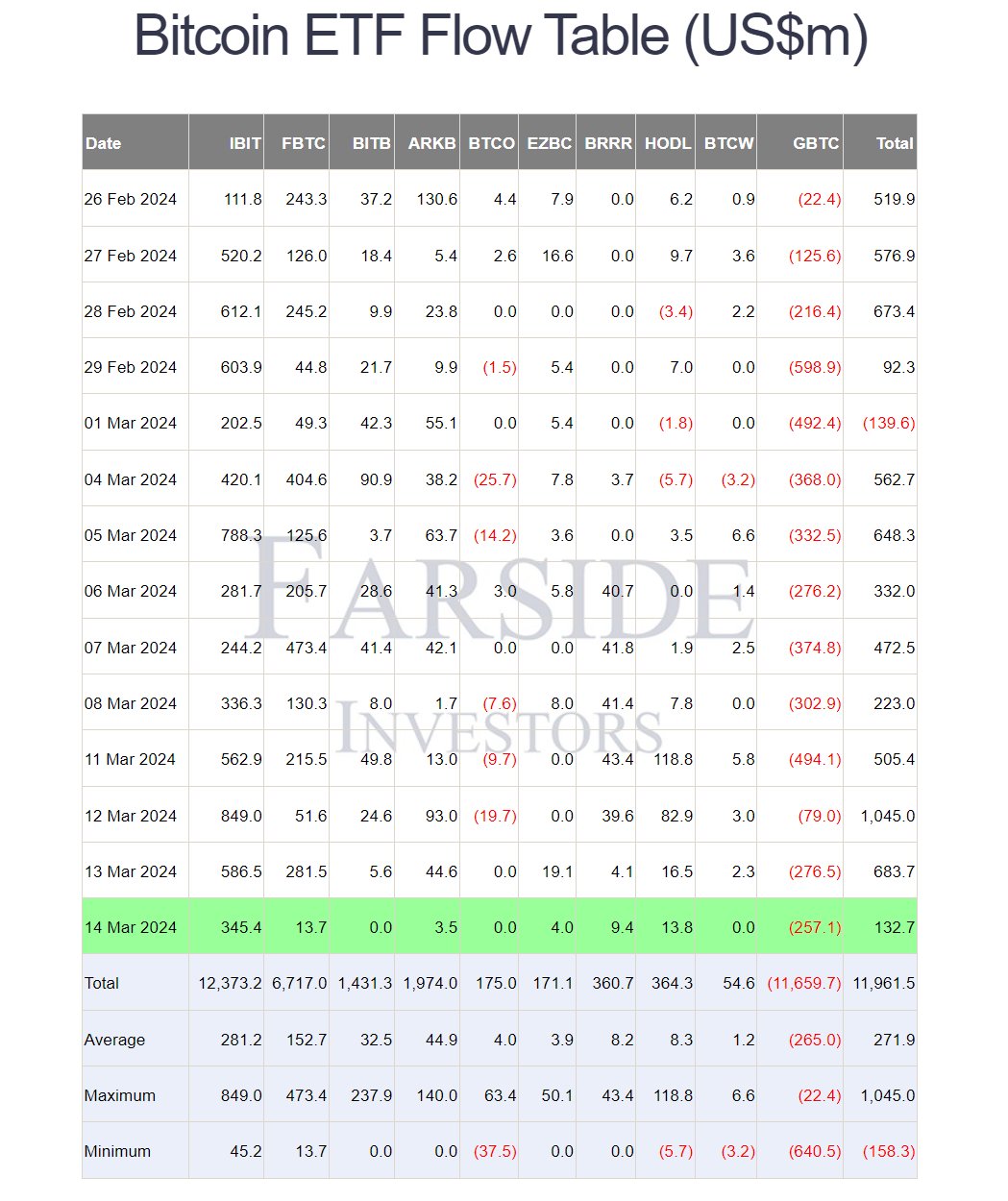

The decline of Bitcoin below $70,000 is partly attributed to the “Coinbase Premium” dipping into negative territory. This indicates bearish sentiment from US markets. Additionally, inflows into spot Bitcoin ETFs have slowed down, while Grayscale GBTC has experienced significant outflows. This has put downward pressure on Bitcoin’s price.

Outlook

Despite the current dip, some analysts suggest that the market may rebound. The reduced inflow into spot ETFs is still significant, and overleveraged traders are being forced to sell. This could create a buying opportunity in the near future.