Price Surge and Investor Interest

Bitcoin (BTC) has been on a tear, rising 5% in the past day and rapidly approaching the $60,000 mark. This surge in price is driven by renewed investor interest in the world’s largest cryptocurrency, which is approaching its all-time high.

Pre-Halving Rally

The price increase coincides with a surge in demand for spot bitcoin exchange-traded funds (ETFs), which saw trading volumes exceeding $3 billion on Tuesday. Additionally, traders speculate that the upcoming April bitcoin halving is fueling a pre-halving rally.

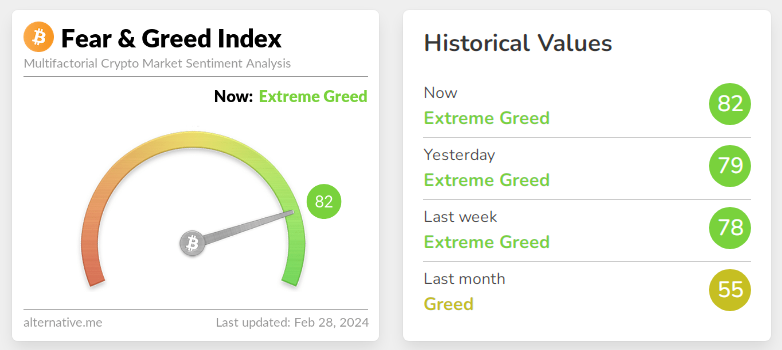

Extreme Greed

The Fear and Greed Index, which measures investor sentiment, has reached 82, indicating “extreme greed” and hitting its highest level in over a year. This suggests that the market is overly optimistic and may be due for a correction.

Analysts’ Outlook

Analysts believe that the current upward trend in pricing is just the beginning. Ryan Rasmussen of Bitwise Asset Management states that the demand for spot bitcoin ETFs is outpacing the supply, driving prices higher. He predicts that cryptocurrency is “rising from the ashes of the 2022 market.”

Trading Activity

The volume of bitcoin trades has surpassed the totals for each quarter of 2023 during the same period. Major trading platforms like Coinbase and Robinhood have benefited from this activity, with their stocks rising significantly since the start of the year.