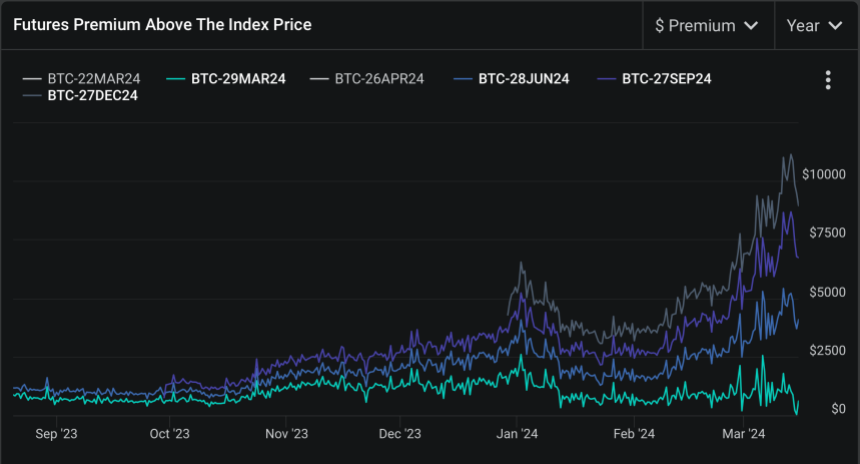

Bullish Signals from Bitcoin Futures

The Bitcoin futures market is showing signs that have historically signaled a bullish trend. The futures basis, which measures the difference between the futures price and spot price of Bitcoin, has climbed to its highest level since Bitcoin’s all-time high in 2021.

Trading Opportunities

This elevated basis creates opportunities for traders. By buying Bitcoin in the spot market and selling futures contracts at a premium, traders can lock in a profit regardless of Bitcoin’s price volatility.

Market Optimism

The high futures basis reflects broader market optimism. Regulatory approvals for Bitcoin ETFs and anticipation of the Bitcoin halving event have fueled confidence in the market.

Halving Cycles

While Bitcoin’s price has recently dipped, analysts view this as a temporary setback. Halving events, which reduce the supply of new Bitcoin, have historically led to price rallies.

Current Market Trajectory

Bitcoin’s current trajectory aligns with historical halving cycles. A pre-halving rally has been followed by a retracement phase, which is what we are currently seeing. This suggests that the recent dip is a temporary setback before the next bullish phase.