Inflows Soar to $2.2 Billion

Bitcoin exchange-traded funds (ETFs) have been on a roll, with a whopping $2.2 billion pouring into them over the past week. This surge surpasses any other ETF in the US during the same period.

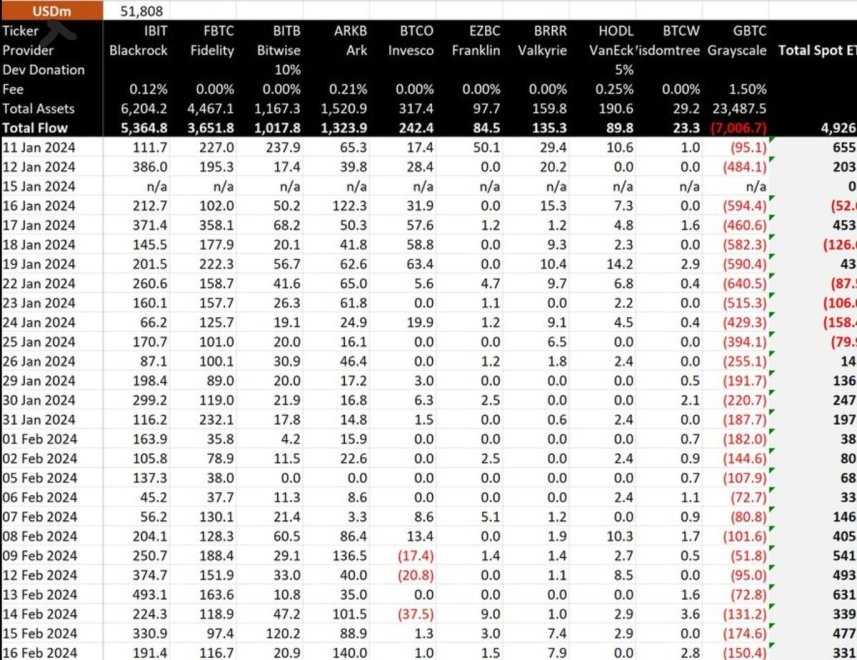

BlackRock Dominates

BlackRock’s IBIT ETF has been the biggest beneficiary, raking in over $1.6 billion in the past week alone. This brings its total net inflows to an impressive $5.2 billion.

Fidelity and Ark Invest Follow Suit

Fidelity’s FBTC and Ark Invest’s BTCO have also seen significant inflows, with $648.5 million and $1.3 billion respectively since the start of the year.

Grayscale’s GBTC Sees Outflows

Grayscale’s GBTC ETF, on the other hand, has experienced outflows of $623 million in the past week. This marks an increase from the previous week’s outflows.

Price Impact

The influx of funds into Bitcoin ETFs has had a positive impact on the cryptocurrency’s price, which has risen to its highest level in over two years. On Thursday, February 15, Bitcoin surpassed the $52,000 mark.

ETF Trading Volume on the Rise

According to Santiment, Bitcoin ETF trading volume has surged since the start of February. The seven largest ETFs have recorded over $1.8 billion in daily trading volume in the first half of the month.

Bitcoin Price Fluctuates

As of writing, Bitcoin is trading at $51,326, down 1.3% in the past 24 hours.