Grayscale’s GBTC Struggles with High Fees

Grayscale’s Bitcoin Trust (GBTC) has lost $11 billion in assets due to its higher fees. Investors have been switching to competing ETFs with lower costs.

Grayscale Considers Spin-Off

To address this issue, Grayscale is considering a spin-off. They plan to create a new ETF called the “Grayscale Bitcoin Mini Trust.” GBTC shareholders will receive shares in the new trust, but the fees for the Mini Trust are still unknown.

VanEck Cuts Fees to Zero

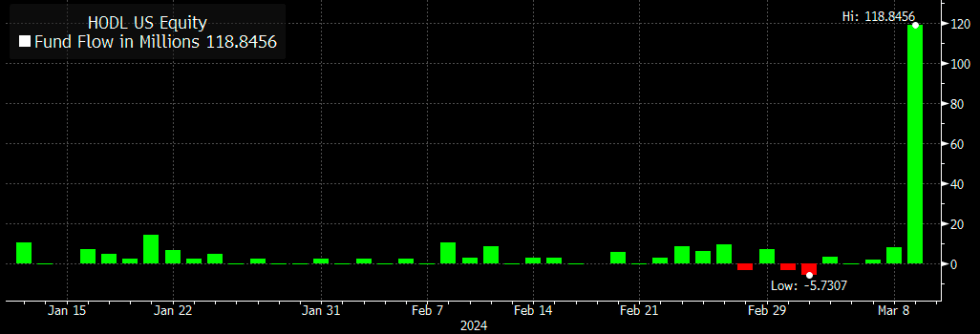

Asset manager VanEck has temporarily slashed fees to zero for its HODL Bitcoin ETF. This move aims to attract investors and boost assets under management. The fee waiver will last until March 2025 or until the fund reaches $1.5 billion in assets.

Bitcoin ETF Market Heats Up

The fee war in the Bitcoin ETF market is intensifying. Grayscale’s spin-off and VanEck’s fee reduction are examples of the industry’s efforts to gain market share.

Conclusion

The Bitcoin ETF market is becoming increasingly competitive. Asset managers are offering lower fees and new products to attract investors. As the market evolves, investors should stay informed about the latest developments to make informed investment decisions.