Demand from Long-Term Holders

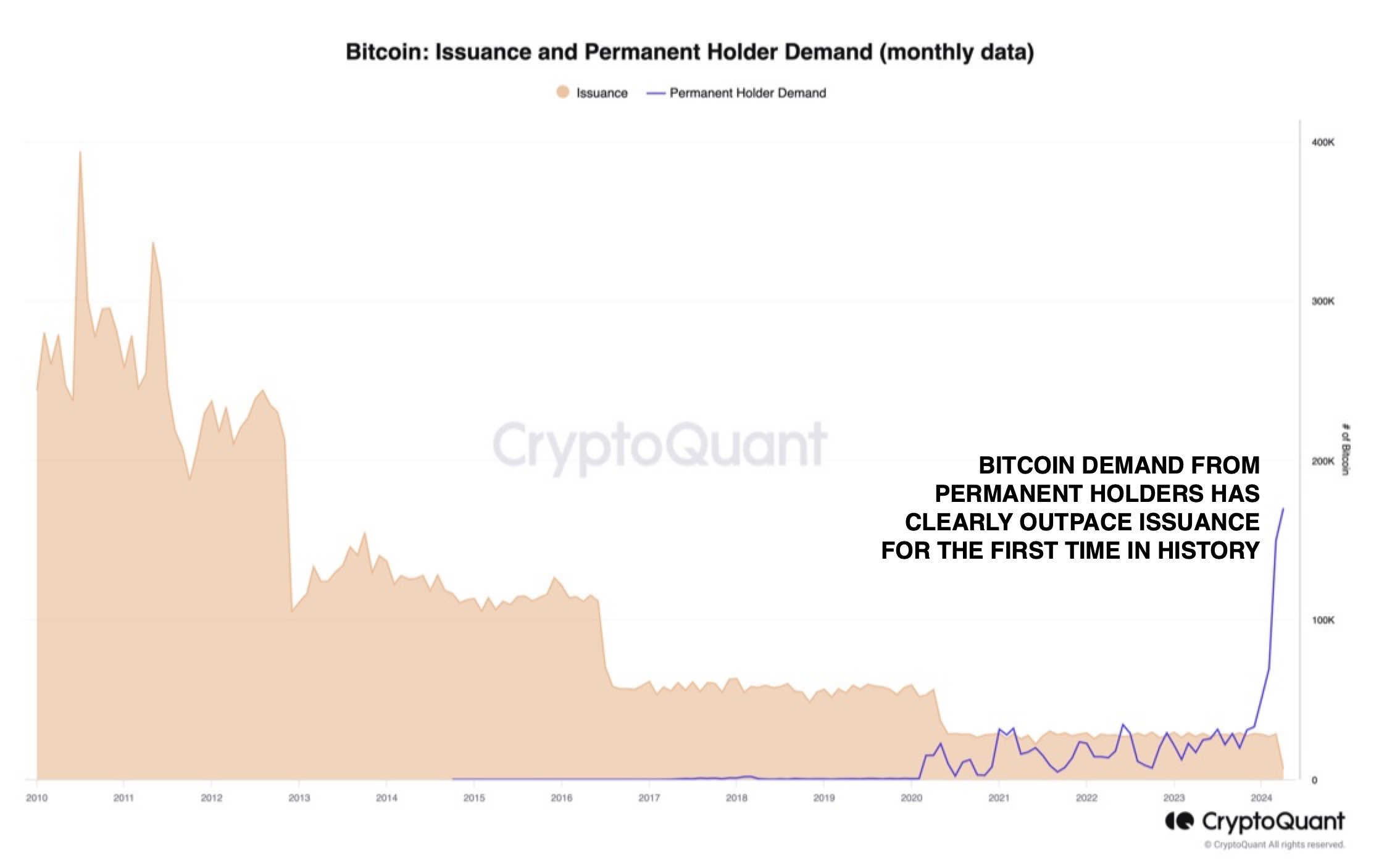

Data from CryptoQuant shows that demand for Bitcoin from long-term holders (HODLers) has reached unprecedented levels, outpacing the supply produced by miners.

HODLers, who own “accumulation addresses” that have only purchased BTC and never sold it, are known for holding their assets indefinitely. As a result, the new supply they accumulate is likely to become similarly illiquid in the future.

Miner Issuance

Miner issuance refers to the amount of Bitcoin produced by miners when they solve blocks and receive block rewards. These rewards are the only way to increase the cryptocurrency’s circulating supply.

Demand Outstrips Supply

Since 2020, demand from accumulation addresses has surged and remained elevated. Recently, this demand has exploded, surpassing the issuance of miners by a significant margin.

This suggests that HODLers are buying more Bitcoin than miners are producing. This is only a portion of the total network demand, as there are other buyers, but it highlights the strong demand for BTC.

Drivers of Demand

A major driver behind this demand is the emergence of Bitcoin spot exchange-traded funds (ETFs), which offer an alternative way for traditional investors to gain exposure to the cryptocurrency.

Bitcoin Price

At the time of writing, Bitcoin is trading at around $68,400, up over 4% in the past week.