Bitcoin (BTC) might be on the verge of a significant price surge, according to a prominent analytics firm, Santiment.

Oversold Market:

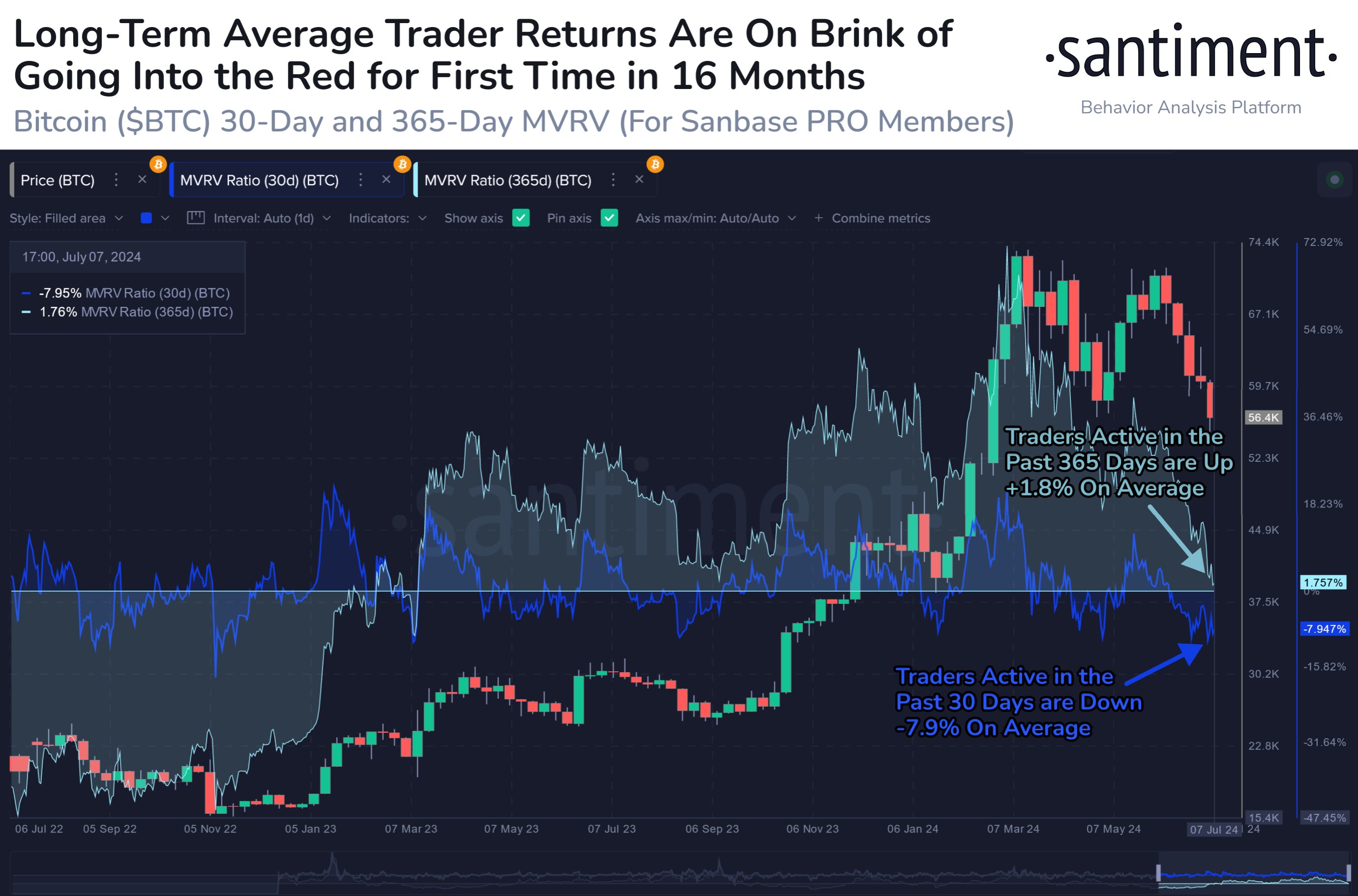

Santiment is keeping a close eye on Bitcoin’s Market Value to Realized Value (MVRV), a metric that helps determine if the market is oversold. When the MVRV drops below zero, it suggests that many traders are losing money, indicating an oversold market.

Historical Pattern:

Santiment noticed that both the 30-day and 365-day MVRV for Bitcoin are currently in negative territory. This happened in March 2023, just before Bitcoin rallied from $20,000 to $74,000.

Buying Opportunity:

“When both Bitcoin’s 30-day and 365-day MVRV are negative, it’s a sign that you’re buying when other traders are experiencing pain,” said Santiment. “If you had bought the last time this happened, your return on BTC would have been over 132%.”

Fading Fear:

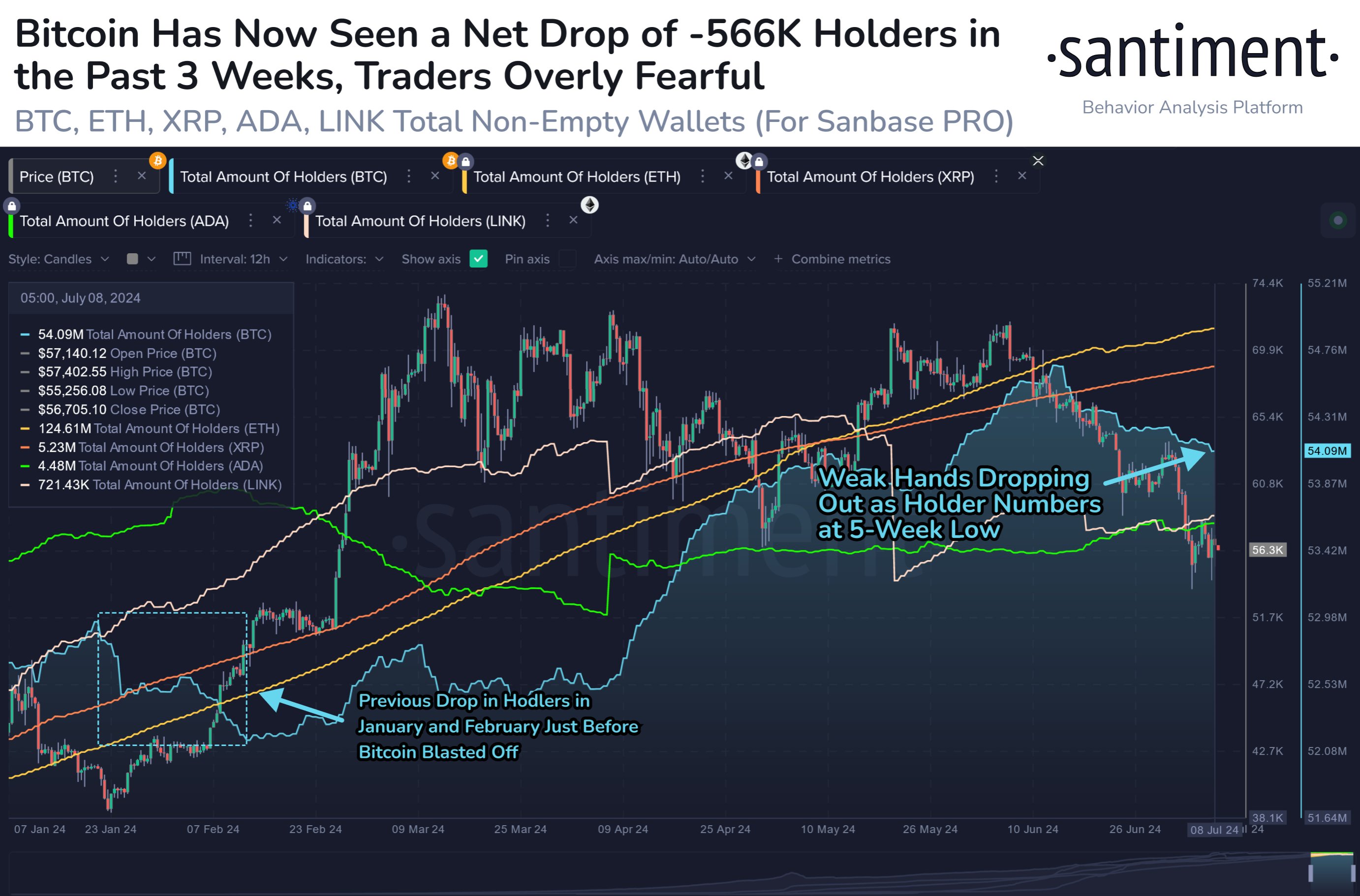

Since June 15th, the number of active Bitcoin wallets has decreased significantly, suggesting that many investors are selling their Bitcoin out of fear. However, Santiment believes this is a positive sign. “This is a sign of a bottom, just like we saw in January 2024,” they said.

Low Sentiment:

Crowd sentiment for Bitcoin is currently at a one-year low, indicating a lot of negativity among traders. This, according to Santiment, increases the probability of a rebound. “When the crowd is this fearful, there’s a good chance of a bounce that could surprise many,” they said.

Potential for a Rally:

While Bitcoin is currently trading at $57,881, Santiment’s analysis suggests that the market might be setting up for a significant price increase. The combination of oversold conditions, fading fear, and low sentiment could lead to a positive shift in the market.